Community Care Services (CCS) is a not-for-profit organization formed in January 2013 and is located in the

Question:

Our mission is to provide a secure retirement community in a carefully selected location in the heart of our beloved Thomas County. Our organization provides a warm, attractive setting as the surroundings for a vibrant, healthy living space€”one that our residents deserve. Our vision is to serve the community, and it encompasses accommodation and leisure as well as the provision of health care.

Background information on CCS is provided in Exhibit I , and some details of CCS€™s operations are included in Exhibit II . The executive director, Janet Admer, joined the organization in the last month and was recruited from a nearby city. Janet has extensive experience in managing the construction and operations of a major hotel. It was the board of directors€™ view that, even though Janet€™s salary of $120,000 seemed high, her hospitality-industry skills would be a good contribution to the operation of CCS.

It is now November 15, 2013. You have known Janet Admer for many years, and she has approached you for advice. Janet has asked your firm, Yelt and Rerdan, Chartered Accountants, to advise her and the board on the issues facing CCS as it moves from the construction phase to the operating phase. Janet has prepared a cash budget, included in Exhibit III , and she is very pleased that her estimate indicates that a surplus will exist in the first year of full operation. Because the board members would like to make sure that CCS will have sufficient cash to meet its obligations as it starts to operate the residences, Janet wants you to look at her budget. The board had approved obtaining a bank loan to complete the construction phase but is still concerned that there is a risk that CCS will run out of cash by the end of the year.

CCS has already appointed KZY, Chartered Accountants, as the auditor, and KZY will be reporting on the first fiscal year-end of December 31, 2013. Janet has deliberately not assigned the engagement to you and your firm so that the functions of auditor and advisor will be independent.

The board is made up of highly respected individuals in the community; however, the members have very little experience in running an operation such as CCS. Janet would like you to help her determine the kind of information, financial and otherwise, that would be useful to them to evaluate the performance of CCS in meeting its goals.

You are pleased at the prospect of bringing in a client to the firm, and you have discussed the engagement with a partner at Yelt and Rerdan. The partner has agreed to accept the engagement and has asked you to prepare a draft report addressing Janet€™s requests.

Required:

Prepare the draft report addressing Janet€™s requests, including a comprehensive analysis of CCS€™s cash fl ow situation and an analysis of CCS€™s information needs.

Exhibit I

In the last decade, foreign investors who believed that land was a bargain as a result of the weak Canadian dollar have purchased many of the farms in Thomas County. The community was concerned that there were no residential alternatives in the county for older farmers who left their farms as a result of a sale or retirement.

Mr. MacDougall, an advocate for the local farmers and seniors, started with the idea of providing residential options to the families. He was instrumental in setting up CCS and was appointed the chairman of the board. He donated 10 acres of land from his farm for the facility.

He also donated $1 million for the construction of the residential units. The conditions of the donations were as follows:

1. The land can never be sold.

2. At least one-third of all residential units must be provided to low-income seniors who must meet an annual income test, and the rent charged cannot generate a surplus on the operational costs of these units. (These units have been designated as Building C.)

3. At least one-third of all residential units must provide full health care services. (These units have been designated as Building A, commonly referred to as the €œNursing Home.€)

4. One-half of the sales proceeds from the retirement home sales units must be maintained in a separate account to be used for the maintenance and capital repairs of the complex.

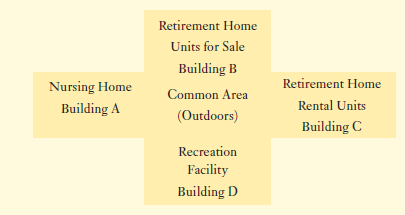

If these terms are not met the land reverts to Mr. MacDougall, or to a special MacDougall trust if the breach occurs after the death of Mr. MacDougall. The layout of the complex is as follows:

Construction began in February 2013 and is almost complete. The nursing home and both retirement homes are completed. The recreation facility is scheduled to be completed by December 31. All of the units in the nursing home and the rental retirement home have been assigned to residents. Sales contracts have been signed for all of the units in the other retirement home. These sales are expected to close in January 2014. The complex is expected to be fully operational in early January 2014.

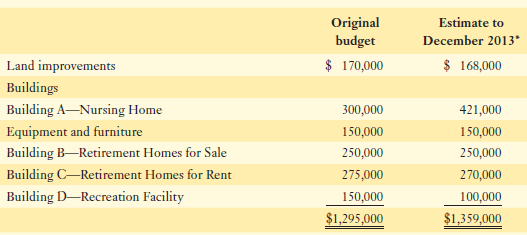

The costs of construction and the budget are as follows:

* Total actual costs incurred plus revised estimate to complete.

Exhibit I

Source of funds

Mr. MacDougall ............................................................................................. $1,000,000

Thomas County Grant .................................................................................. 200,000

Bank loan€”no interest until January 1, 2014, then payments of

$20,000 per month, plus annual interest of 5%. ....................................... 200,000

$1,400,000

Exhibit II

Additional information

Building A€”Nursing Home

This building has 20 beds and its operations will be funded by the provincial government€™s Ministry of Community and Social Services (the ministry). The funding formula is $130 per day per bed, and any surplus from operations must be returned to the ministry. To determine the surplus, the ministry will allow direct costs plus a reasonable allocation of overheads. The ministry, which provides some funding, has requested the audit of the annual financial statements as part of the funding requirement.

Building B€”Retirement Home, Units for Sale

There are 10 unfurnished units and the residents will have a €œlife-lease€ on the land, which means that the residents will have the right to use the portion of the land on which the building is located but they will not own it, and the right will expire at either the death of the resident or sooner if mutually agreed to. In addition to the purchase price, the residents will also pay $550 per month to cover the occupancy costs, and this amount could be adjusted to meet actual costs if necessary. There are two types of €œsales€ and there are five units of each type:

Type I €”The units are €œsold€ for fair market value. At the end of the lease (i.e., death or resident moves out), CCS must pay back the full price paid.

Type II €”The units are €œsold€ for 120% of fair market value. At the end of the lease (i.e., death or resident moves out), CCS must pay back the fair market value at the date the resident purchased the unit plus 50% of any increase in value.

For both types, CCS has the right to select the next occupant, and the price to be charged for the unit is to be based on fair market value and must be supported by an independent opinion. The fair market value for all the initial sales was determined to be $100,000. The board is confident that the value of these units will increase. These units are designed to appeal to those who want a €œpremium€ unit and can afford to pay for it.

Building C€”Retirement Home, Rental Units

There are 15 unfurnished units. The rent will be approximately $400 per month per unit and

includes all utilities, cable, etc. To be eligible for these units, the applicants must prove that

the combined annual income available to them is not more than $20,000. CCS will receive an

annual operating grant of $200,000 from the ministry.

Building D€”Recreation Facility

When it is completed, Building D will hold the administration offices and a recreation facility to be used for social activities. The residents of all buildings can use the common area and recreation facility.

Other

Each of the four buildings has a staff member employed as the €œProgram Director.€ Each program director has an annual salary of $60,000. The total administrative costs incurred in 2013 are expected to be limited to $115,000.

Exhibit III

Budgeted operating cash flows

for the Year Ending December 31, 2014

(in $000€™s)

Cash inflows

Government funding€”Nursing Home (20 beds × $130 × 365 days) ................................... $ 949

Government funding€”Retirement Home rental units .......................................................... 200

Sales proceeds€”Retirement Home sales units ...................................................................... 1,100

Occupancy fees€”Retirement Home sales units (10 units × $550 × 12 months) ................ 66

Rent€”Retirement Home rental units (15 units × $400 × 12 months) .................................. 72

Interest (same amount as earned in 2013) .............................................................................. 29

2,416

Cash outflows

Salaries and benefits (including medical staff costs of $260) ................................................ 850

Medical supplies .......................................................................................................................... 55

Furniture and equipment (Nursing Home and Administration) ............................................. 44

Food costs€”Nursing Home ......................................................................................................... 160

Staff training (one-time cost) ........................................................................................................ 34

Repairs and maintenance ............................................................................................................. 23

Communications, office, etc. ....................................................................................................... 15

Utilities and property taxes .......................................................................................................... 23

Insurance ........................................................................................................................................ 10

1,214

Excess of cash inflows over cash outflows ............................................................................. $1,202

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: