Question: Refer to P14A-49 above. Assume that Jamie designated the forward as a cash flow hedge. Required: Record the required journal entries for June 18, June

Refer to P14A-49 above. Assume that Jamie designated the forward as a cash flow hedge.

Required:

Record the required journal entries for June 18, June 30, and August 12, using the net method. If no entries are required, state “no entry required” and indicate why.

P14A-49

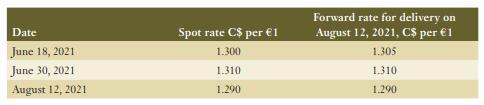

On June 18, 2021, Jamie Banfied Inc. signed a contract to sell machinery for €100,000 (inventoried cost C$110,000) for delivery on August 12, 2021. Terms of the sale were COD (cash on delivery). Jamie, which has a June 30 year-end, entered into a forward agreement to sell €100,000 on August 12 to mitigate its foreign exchange risk. Jamie designated the forward a fair value hedge. Pertinent exchange rates follow:

Date June 18, 2021 June 30, 2021 August 12, 2021 Spot rate C$ per 1 1.300 1.310 1.290 Forward rate for delivery on August 12, 2021, C$ per 1 1.305 1.310 1.290

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

For June 18 2021 No entry required The forward contract was entered into on this date b... View full answer

Get step-by-step solutions from verified subject matter experts