Question: Corus Manufacturing Ltd. has a defined benefit pension plan that covers its production employees. On September 1, 2008, Corus initiated this plan and had immediately

Corus Manufacturing Ltd. has a defined benefit pension plan that covers its production employees. On September 1, 2008, Corus initiated this plan and had immediately contributed $12 million toward covering the costs of the plan because the plan provided for retroactive benefits. The actuary valued these retroactive benefits at $12 million.

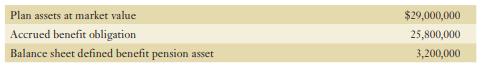

You have the following information with respect to the plan as at August 31, 2018 (10 years after the plan initiation):

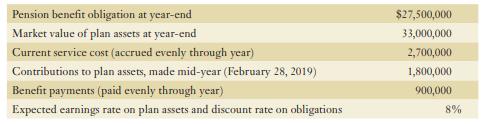

Information for fiscal year ended August 31, 2019:

Required:

a. Using the above information, prepare the schedules in the note disclosures reconciling the beginning and ending balances of the pension’s assets and liabilities for the 2019 fiscal year.

b. Derive the pension expense for the fiscal year ended August 31, 2019.

c. Record the journal entries relating to the pension plan for the 2019 fiscal year.

Plan assets at market value Accrued benefit obligation Balance sheet defined benefit pension asset $29,000,000 25,800,000 3,200,000

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

a Schedule of reconciliation of beginning and ending balances of pensions assets Beginning balance A... View full answer

Get step-by-step solutions from verified subject matter experts