Question: DB Company operates a defined benefit pension plan. Until January 1, 2017, DB Company had a defined contribution plan that had been retroactively changed to

DB Company operates a defined benefit pension plan. Until January 1, 2017, DB Company had a defined contribution plan that had been retroactively changed to a defined benefit plan. The plan was on this date underfunded by $1,000,000. DB Company has a December 31 year-end.

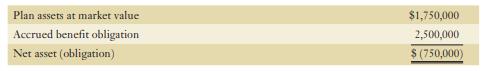

On January 1, 2019, valuations were completed with the following results:

The company uses the following assumptions for its pension plan:

The company uses the following assumptions for its pension plan:

■ Discount rate on obligations and expected rate of investment return: 8%

■ All accruals and payments take place at mid-year.

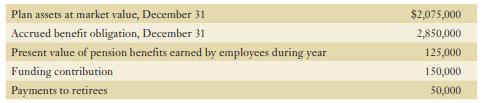

The following data are relevant for 2019:

Required:

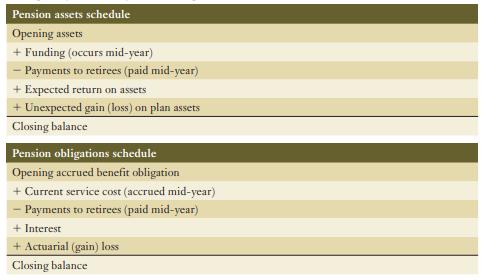

a. Using the above information, complete the following note disclosures reconciling the opening and closing balances of pension assets and liabilities for 2019.

b. Calculate the pension expense to be recognized in 2019 and show the individual components making up the pension expense.

c. Record the journal entries for DB’s pension in 2019.

Plan assets at market value Accrued benefit obligation Net asset (obligation) $1,750,000 2,500,000 $ (750,000)

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

a Pension assets schedule Opening assets 2075000 2500000 1000000 575000 Funding occurs midyear 12500... View full answer

Get step-by-step solutions from verified subject matter experts