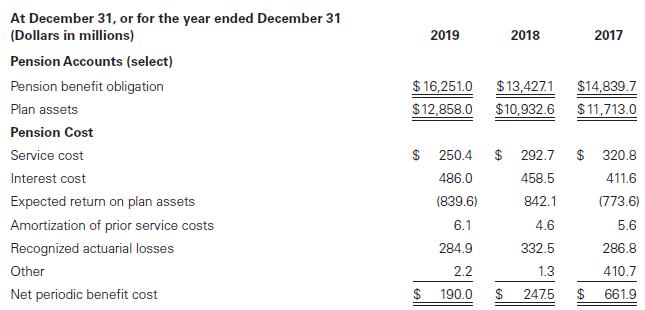

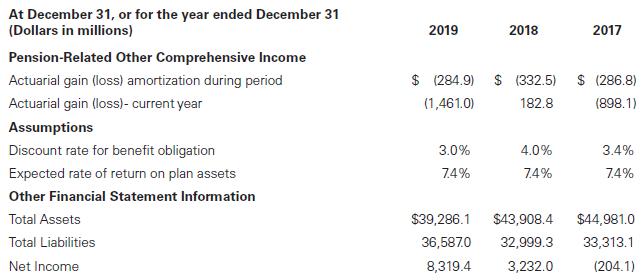

Eli Lilly and Company, a global pharmaceutical company, offers defined-benefit plans to its employees. The following table

Question:

Eli Lilly and Company, a global pharmaceutical company, offers defined-benefit plans to its employees. The following table presents select data about Eli Lilly’s defined-benefit pension plan. Eli Lilly reports under U.S. GAAP. Use this information to answer the questions that follow regarding Eli Lilly’s defined-benefit pension plan, including its pension costs and liability.

a. What is Eli Lilly’s pension cost in 2019, 2018, and 2017? What are the components of its pension cost? What are pension costs after taxes as a percentage of net income? Comment on any changes in pension costs after taxes as a percentage of net income. Consider the growth in net income compared to the growth in pension costs after taxes. Assume a 21% tax rate in 2019 and 2018 and a 35% tax rate in 2017.

b. What is the funded status of Eli Lilly’s defined-benefit pension plans in 2019, 2018, and 2017? How has the funded status changed over time? What is the percent of the net pension liability to total liabilities in 2019, 2018, and 2017?

c. How have the settlement rate and expected return on plan assets changed from 2017 to 2019? How does the change in the settlement rate affect the pension obligation and pension cost? How does the change in the expected return on plan assets affect the pension cost?

d. If Eli Lilly had reported all actuarial gains and losses in net income rather than other comprehensive income, what would its pension cost have been in 2019, 2018, and 2017? Comment on the changes in its pension cost.

e. From Example 19.29 in the text, compare pensions at Eli Lilly to those at Johnson & Johnson. Specifically, compare the pension costs after taxes as a percentage of net income and the net pension obligation as a percentage of liabilities.

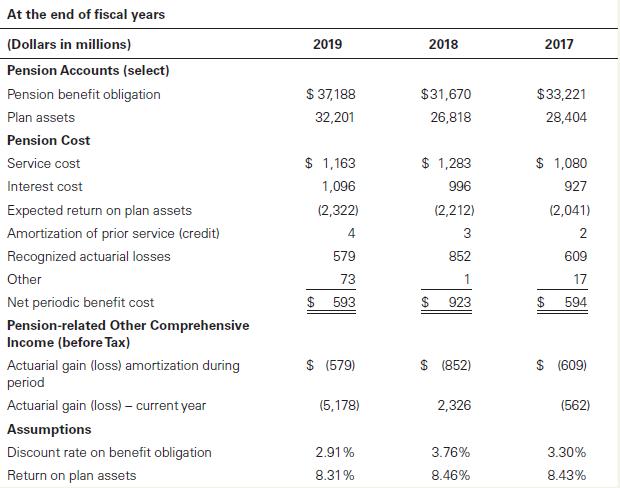

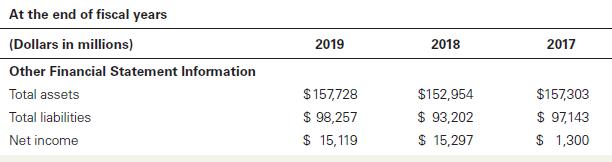

Data from Example 19.29

You are interested in better understanding Johnson & Johnson’s defined-benefit pension plan, including its pension costs and liability. The following table presents select data about Johnson & Johnson’s defined-benefit pension plan; use this information to answer the questions that follow.

Required

a. What is Johnson & Johnson’s pension cost in 2019, 2018, and 2017? What are the components of its pension cost? What are pension costs after taxes as a percentage of net income? Comment on any changes in pension costs after taxes as a percentage of net income. Assume a 21% tax rate in 2019 and 2018, and a 35% tax rate in 2017.

b. What is the funded status of Johnson & Johnson’s defined-benefit pension plans in 2019, 2018, and 2017, respectively? How has the funded status changed over time? What is the percent of the net pension liability to total liabilities in 2019, 2018, and 2017, respectively?

c. How have the settlement rate and expected return on plan assets changed from 2015 to 2019? How does the change in the settlement rate affect the pension obligation and pension cost? How does the change in the expected return on plan assets affect the pension cost?

d. If Johnson & Johnson had reported all actuarial gains and losses in net income rather than other comprehensive income, what would its pension cost have been in 2019, 2018, and 2017, respectively? Comment on the changes in its pension cost.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella