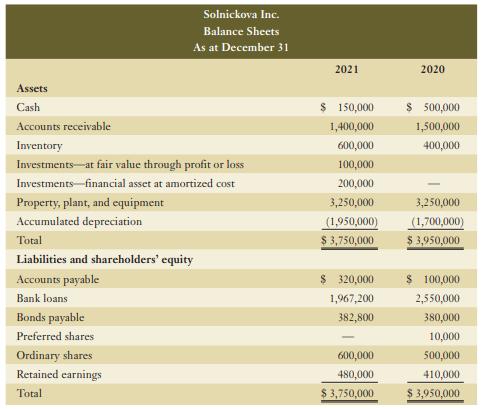

Financial information for Solnickova Inc. follows: Additional information: Preferred shares were converted to common shares during

Question:

Financial information for Solnickova Inc. follows:

Additional information:

■ Preferred shares were converted to common shares during the year at their book value.

■ The face value of the bonds is $400,000; they pay a coupon rate of 5% per annum. The effective rate of interest is 6% per annum.

■ Net income was $80,000.

■ There was an ordinary stock dividend valued at $4,000 and cash dividends were also paid.

■ Interest expense for the year was $125,000. Income tax expense was $20,000.

■ Solnickova arranged for a $250,000 bank loan to finance the purchase of the held-to maturity investments.

■ Solnickova has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities, respectively.

■ The at fair value through profit or loss investments are held for trading purposes.

Required:

a. Prepare a statement of cash flows for the year ended December 31, 2021, using the indirect method.

b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements.

c. Independent of part (a), assume that Solnickova held the $100,000 investment to meet short-term cash commitments. Summarize the impact of this change on the company’s statement of cash flows for the year ended December 31, 2021.

Step by Step Answer: