Question: For the year ended October 31, 2017, BMO Financial Group (Bank of Montreal) reported income before tax of $6,646 million and income tax expense of

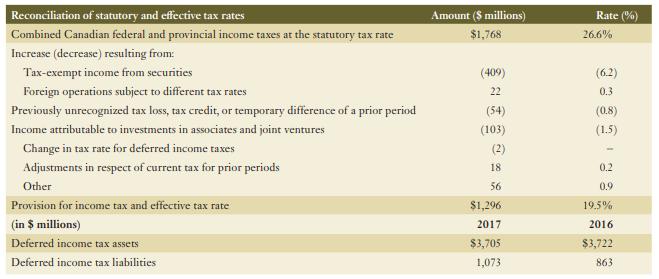

For the year ended October 31, 2017, BMO Financial Group (Bank of Montreal) reported income before tax of $6,646 million and income tax expense of $1,296 million for an effective tax rate of 19.5%. In the notes to the financial statements, BMO’s disclosures included the following information:

Required:

a. From BMO’s disclosures provided above, identify any permanent differences.

b. In which direction did the tax rate change?

c. Refer to the line “Adjustments in respect of current tax for prior periods” in the above disclosures. What does this information imply about BMO’s treatment of tax losses in prior years?

Reconciliation of statutory and effective tax rates Combined Canadian federal and provincial income taxes at the statutory tax rate Increase (decrease) resulting from: Tax-exempt income from securities Foreign operations subject to different tax rates Previously unrecognized tax loss, tax credit, or temporary difference of a prior period Income attributable to investments in associates and joint ventures Change in tax rate for deferred income taxes Adjustments in respect of current tax for prior periods Other Provision for income tax and effective tax rate (in $ millions) Deferred income tax assets Deferred income tax liabilities Amount ($ millions) $1,768 (409) 22 (54) (103) (2) 18 56 $1,296 2017 $3,705 1,073. Rate(%) 26.6% (6.2) 0.3 (0.8) (1.5) 0.2 0.9 19.5% 2016 $3,722 863

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

a Permanent differences are items of income or expense that are included in the companys taxable inc... View full answer

Get step-by-step solutions from verified subject matter experts