Question: Gary Construction Associates accepted a contract to build an office building on January 2, 2018. The company will complete the contract within two years. Gary

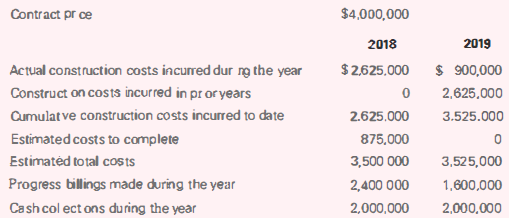

Gary Construction Associates accepted a contract to build an office building on January 2, 2018. The company will complete the contract within two years. Gary provided the following information related to the revenue, estimated costs, progress billings, and collections over the two-year period.

$4,000,000 Contract pr ce 2019 2018 $ 900,000 Actual construction costs incurred dur ng the year $2,625,000 Construct on costs incurred in pr or years 2,625,000 Cumulatve construction costs incurred to date 2.625.000 3.525.000 Estimated costs to complete 875,000 Estimatd to tal costs 3,525,000 3,500 000 Progress billings made during the year 2,400 000 1,600,000 Cash col ect ons during the year 2,000,000 2,000,000

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

2018 2019 Actual cumulative costs incurred to date 2625000 3525000 Estimated total costs 3500000 352... View full answer

Get step-by-step solutions from verified subject matter experts