Grant Wood Corporation?s balance sheet at the end of 2019 included the following items. The following information

Question:

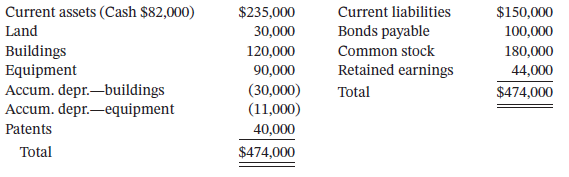

Grant Wood Corporation?s balance sheet at the end of 2019 included the following items.

The following information is available for 2020.

1. Net income was $55,000.

2. Equipment (cost $20,000 and accumulated depreciation $8,000) was sold for $10,000.

3. Depreciation expense was $4,000 on the building and $9,000 on equipment.

4. Patent amortization was $2,500.

5. Current assets other than cash increased by $29,000. Current liabilities increased by $13,000.

6. An addition to the building was completed at a cost of $27,000.

7. A long-term investment in stock was purchased for $16,000.

8. Bonds payable of $50,000 were issued.

9. Cash dividends of $30,000 were declared and paid.

10. Treasury stock was purchased at a cost of $11,000.

Instructions

(Show only totals for current assets and current liabilities.)

a. Prepare a statement of cash flows for 2020.

b. Prepare a balance sheet at December 31, 2020.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel