In 2015, Meagan Inc. purchased a parcel of land for future expansion of its manufacturing plant for

Question:

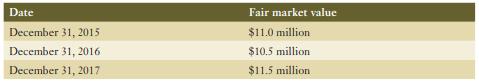

In 2015, Meagan Inc. purchased a parcel of land for future expansion of its manufacturing plant for $10 million. The company initially opted to value the asset using the revaluation model. The land was subsequently revalued at year-end as set out below:

In December 2018, before the books for the year were closed, the company elected to account for the land using the cost model as it provided more relevant information about its financial performance.

Required:

Record any adjusting journal entries required to reflect the change in accounting policy. Include the effect of income taxes, assuming that Meagan Inc.’s tax rate was 25% for all years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: