Question: On September 20, 2020, Marshall Inc., whose year-end is December 31, paid $2,000,000 to purchase land. Marshall Inc. initially elected to subsequently measure the land

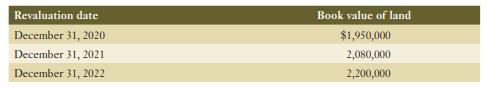

On September 20, 2020, Marshall Inc., whose year-end is December 31, paid $2,000,000 to purchase land. Marshall Inc. initially elected to subsequently measure the land using the revaluation model. In 2023, the company decided to use the cost model to subsequently measure its land to enhance the comparability of its financial statements to those of its competitors. Its tax rate is 20%.

Required:

Prepare the journal entry to retrospectively account for this change in accounting policy. Include the effect of income taxes.

Revaluation date December 31, 2020 December 31, 2021 December 31, 2022 Book value of land $1,950,000 2,080,000 2,200,000

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Journal Entry Debit Accumulated Depreciation 20X3 130000 Credit Land 2000000 Credit Income ... View full answer

Get step-by-step solutions from verified subject matter experts