Question: In the table below, choose the derivative instrument on the left side that best matches the example on the right side. There is one example

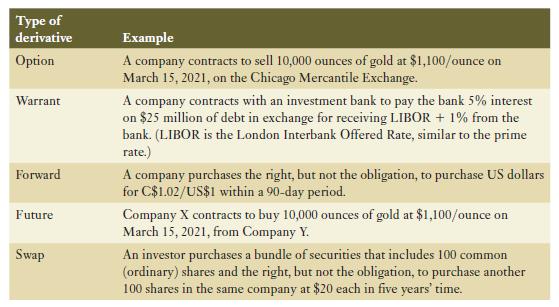

In the table below, choose the derivative instrument on the left side that best matches the example on the right side. There is one example for each instrument.

Type of derivative Option Warrant Forward Future Swap Example A company contracts to sell 10,000 ounces of gold at $1,100/ounce on March 15, 2021, on the Chicago Mercantile Exchange. A company contracts with an investment bank to pay the bank 5% interest on $25 million of debt in exchange for receiving LIBOR + 1% from the bank. (LIBOR is the London Interbank Offered Rate, similar to the prime rate.) A company purchases the right, but not the obligation, to purchase US dollars for C$1.02/US$1 within a 90-day period. Company X contracts to buy 10,000 ounces of gold at $1,100/ounce on March 15, 2021, from Company Y. An investor purchases a bundle of securities that includes 100 common (ordinary) shares and the right, but not the obligation, to purchase another 100 shares in the same company at $20 each in five years' time.

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Option A company contracts to sell 10000 ounces of gold at 1100ounce on March ... View full answer

Get step-by-step solutions from verified subject matter experts