Question: Jerry Holiday is the maintenance supervisor for Ray?s Insurance Co. and has recently purchased a riding lawn mower and accessories that will be used in

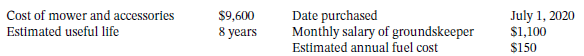

Jerry Holiday is the maintenance supervisor for Ray?s Insurance Co. and has recently purchased a riding lawn mower and accessories that will be used in caring for the grounds around corporate headquarters. He sent the following information to the accounting department:

Calculate the amount of depreciation expense (for the mower and accessories) that should be reported on Ray?s Insurance Co.?s December 31, 2020 income statement. Assume straight-line depreciation and no residual value.

Cost of mower and accessories Estimated useful life Date purchased Monthly salary of groundskeeper Estimated annual fuel cost July 1, 2020 $9,600 8 years $1,100

Step by Step Solution

3.37 Rating (175 Votes )

There are 3 Steps involved in it

1200 Dep reciation Exp ense 96 00 8 ye... View full answer

Get step-by-step solutions from verified subject matter experts