Keeton Company sponsors a defined benefit pension plan for its 600 employees. The company?s actuary provided the

Question:

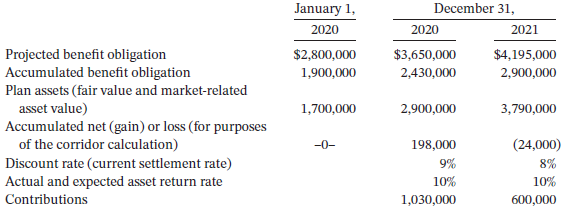

Keeton Company sponsors a defined benefit pension plan for its 600 employees. The company?s actuary provided the following information about the plan.

The average remaining service life per employee is 10.5 years. The service cost component of net periodic pension expense for employee services rendered amounted to $400,000 in 2020 and $475,000 in 2021. The accumulated OCI (PSC) on January 1, 2020, was $1,260,000. No benefits have been paid.

Instructions

(Round to the nearest dollar.)

a. Compute the amount of accumulated OCI (PSC) to be amortized as a component of net periodic pension expense for each of the years 2020 and 2021.

b. Prepare a schedule which reflects the amount of accumulated OCI (G/L) to be amortized as a component of pension expense for 2020 and 2021.

c. Determine the total amount of pension expense to be recognized by Keeton Company in 2020 and 2021.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel