The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses. Incurred

Question:

The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses.

Incurred During the Year ? ? ? ? ? ? ? ? ? (Gain) or Loss2020..................................................................$300,0002021....................................................................480,0002022..................................................................(210,000)2023..................................................................(290,000)

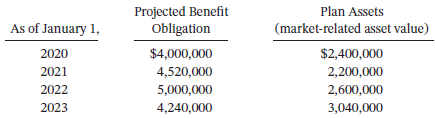

Other information about the company?s pension obligation and plan assets is as follows.

Gustafson Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 5,600. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2020. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization.

Instructions

(Round to the nearest dollar.)

Prepare a schedule which reflects the minimum amount of accumulated OCI (G/L) amortized as a component of net periodic pension expense for each of the years 2020, 2021, 2022, and 2023. Apply the ?corridor? approach in determining the amount to be amortized each year.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel