Linda Monkland established Monkland Ltd. in mid-2019 as the sole shareholder. The accounts on June 30, 2020,

Question:

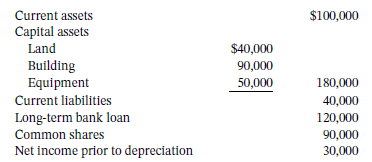

Linda Monkland established Monkland Ltd. in mid-2019 as the sole shareholder. The accounts on June 30, 2020, the company?s year end, just prior to preparing the required adjusting entries, were as follows:

All the capital assets were acquired and put into operation in early July 2019. Estimates and usage information on these assets were as follows:

Building: 25-year life, $15,000 residual value

Equipment: Five-year life, 15,000 hours of use, $5,000 residual value. The equipment was used for 1,000 hours in 2019 and 1,400 hours in 2020 up to June 30.

Linda Monkland is now considering which depreciation method or methods would be appropriate. She has narrowed the choices down for the building to the straight line or double-declining-balance method, and for the equipment to the straight-line, double-declining-balance, or activity method. She has requested your advice and recommendation. In discussions with her, the following concerns were raised:

1. The company acquires goods from suppliers with terms of 2/10, n/30. The suppliers have indicated that these terms will continue as long as the current ratio does not fall below 2 to 1. If the ratio falls lower, no purchase discounts will be given.

2. The bank will continue the loan from year to year as long as the ratio of long-term debt to total assets does not exceed 46%.

3. Ethics Linda Monkland has contracted with the company?s manager to pay him a bonus equal to 50% of any net income in excess of $14,000. She prefers to minimize or pay no bonus as long as conditions of agreements with suppliers and the bank can be met.

4. In order to provide a strong signal to attract potential investors to join her in the company, Ms. Monkland believes that a rate of return on total assets of at least 5% must be achieved.

Instructions

a. Prepare a report for Linda Monkland that (1) presents tables, (2) analyzes the situation, (3) provides a recommendation on which method or methods should be used, and (4) justifies your recommendation by considering her concerns and the requirement that the method(s) used be considered generally acceptable accounting principles. Round the ratio and percentage answers to one decimal place.

b. Digging Deeper What other factors should you discuss with Ms. Monkland to help her in choosing appropriate depreciation methods for her business?

c. Do any ethical issues arise if a depreciation method is chosen in order to manipulate the financial results in a way that will satisfy the constraints listed above? Explain.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy