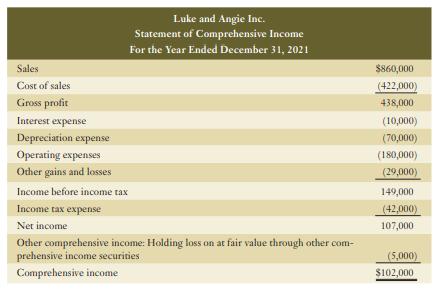

Luke and Angie Inc.s financial statements as at December 31, 2021, appear below: Supplemental financial information for

Question:

Luke and Angie Inc.’s financial statements as at December 31, 2021, appear below:

Supplemental financial information for the year ended December 31, 2021:

■ Luke and Angie exchanged 1,500 preferred shares for plant assets having a fair value of $150,000.

■ Luke and Angie declared and issued 1,000 ordinary shares as a stock dividend valued at $10,000.

■ Goodwill was determined to be impaired and was written down $40,000.

■ Luke and Angie paid $10,000 cash and signed a lease agreement for $90,000 to acquire an ROU asset valued at $100,000.

■ Luke and Angie sold equipment (plant assets) with a net book value of $70,000 for $80,000 cash.

■ Luke and Angie did not buy or sell any at fair value through other comprehensive income securities during the year.

■ Financial asset at amortized cost securities with a book value of $10,000 were called for redemption during the year; $11,000 cash was received.

■ The recorded decrease in the bonds payable account was due to the amortization of the premium.

■ The deferred income tax liability represents temporary differences relating to the use of capital cost allowance for income tax reporting and straight-line depreciation for financial statement reporting.

■ Luke and Angie elects to record interest and dividends paid as an operating activity.

Required:

a. From the information provided, prepare Luke and Angie’s statement of cash flows for the year ended December 31, 2021, using the indirect method.

b. Prepare note disclosure(s) for non-cash transactions.

Step by Step Answer: