Question: Massi Pharmacies, Inc. started operations on January 1, 2018. The company initially used the average-cost method to value its inventory for both book and tax

Massi Pharmacies, Inc. started operations on January 1, 2018. The company initially used the average-cost method to value its inventory for both book and tax purposes. Effective January 1, 2022, Massi elected to change its inventory valuation method to the FIFO basis for financial reporting purposes. Massi still uses the average-cost method on the company’s tax returns. Massi is subject to a 35% tax rate.

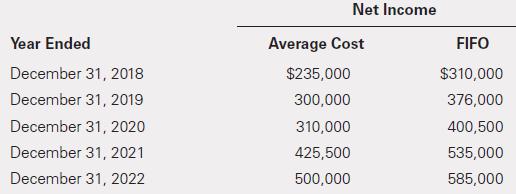

The following information is available for net income after tax for both the FIFO and the average-cost methods.

Required

a. Prepare the journal entry required to record the accounting change on January 1, 2022.

b. Prepare the partial comparative income statements for the 3 years ending December 31, 2022.

c. Prepare the footnote to disclose the change from the average cost to the FIFO basis. Designate the note as “Note A: Change in Method of Accounting for Inventory Valuation.”

Year Ended December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 Net Income Average Cost $235,000 300,000 310,000 425,500 500,000 FIFO $310,000 376,000 400,500 535,000 585,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Computation of the cumulative effect of the change after tax a Journal Entry in the Year of the Chan... View full answer

Get step-by-step solutions from verified subject matter experts