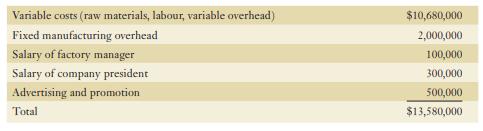

Monster Bikes manufactures off-road bicycles. In 2021, the companys accountant recorded the following costs into the inventory

Question:

Monster Bikes manufactures off-road bicycles. In 2021, the company’s accountant recorded the following costs into the inventory account:

The company had no work in process at the end of both 2020 and 2021. Finished goods at the end of 2020 amounted to 6,000 bikes at $250 per bike. Production was 50,000 bikes and 4,000 bikes remained in inventory at December 31, 2021. The company uses a periodic inventory system and the FIFO cost flow assumption.

Required:

a. Of the $13,580,000, how much should have been capitalized into inventories?

b. Compute the ending value of inventory and the cost of goods sold for 2021.

c. If the error in inventory costing had not been corrected as per part (a), by how much would inventory be overstated at the end of 2021?

d. Record the journal entry to correct the error in inventory costing.

e. If the company uses the weighted-average cost method, how much would be the ending value of inventory and cost of goods sold for 2021?

Step by Step Answer: