Mulholland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to

Question:

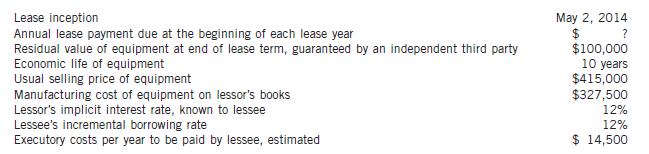

Mulholland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special purpose equipment for a period of seven years. Both Mulholland and Galt follow ASPE. The following information relates to the agreement:

The leased equipment reverts to Galt Manufacturing at the end of the lease, although Mulholland has an option to purchase it at its expected fair value at that time.

Instructions

(a) Using time value of money tables, a financial calculator, or computer spreadsheet functions, calculate the lease payment determined by the lessor to provide a 12% return.

(b) Prepare a lease amortization table for Galt Manufacturing, the lessor, covering the entire term of the lease.

(c) Assuming that Galt Manufacturing has a December 31 year end, and that reversing entries are not made, prepare all entries made by the company up to and including May 2, 2016.

(d) Identify the balances and classification of amounts that Galt Manufacturing will report on its December 31, 2014 balance sheet, and the amounts on its 2014 income statement and statement of cash flows related to this lease.

(e) Assuming that Mulholland has a December 31 year end, and that reversing entries are not made, prepare all entries made by the company up to and including May 2, 2016. Assume payments of executory costs of $14,000, $14,400, and $14,950 covering fiscal years 2014, 2015, and 2016, respectively.

(f ) Identify the balances and classification of amounts that Mulholland will report on its December 31, 2014 balance sheet, and the amounts on its 2014 income statement and statement of cash flows related to this lease.

(g) On whose balance sheet should the equipment appear? On whose balance sheet does the equipment currently get reported?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118300855

10th Canadian Edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy