Question: On December 1, 2021, Aaron Brandon Ltd. entered into a binding agreement to buy inventory costing US$200,000 for delivery on February 16, 2022. Terms of

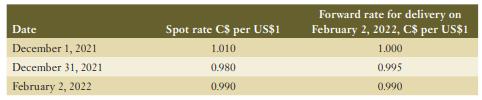

On December 1, 2021, Aaron Brandon Ltd. entered into a binding agreement to buy inventory costing US$200,000 for delivery on February 16, 2022. Terms of the sale were COD (cash on delivery). Aaron, which has a December 31 year-end, decided to hedge its foreign exchange risk and entered into a forward agreement to receive US$200,000 at that time. Aaron designated the forward a fair value hedge. Pertinent exchange rates follow:

Required:

Record the required journal entries for December 1, December 31, and February 2 using the net method. If no entries are required, state “no entry required” and indicate why.

Date December 1, 2021 December 31, 2021 February 2, 2022 Spot rate C$ per US$1 1.010 0.980 0.990 Forward rate for delivery on February 2, 2022, C$ per US$1 1.000 0.995 0.990

Step by Step Solution

3.29 Rating (167 Votes )

There are 3 Steps involved in it

December 1 Debit Accounts Payable US200000 Credit Ca... View full answer

Get step-by-step solutions from verified subject matter experts