On January 1, 2018, Mariannes Massage Inc. (MMI) issued US$5,000,000 of five-year bonds at par that matured

Question:

On January 1, 2018, Marianne’s Massage Inc. (MMI) issued US$5,000,000 of five-year bonds at par that matured on December 31, 2022. Pertinent details follow:

■ The coupon rate on the bonds was 6% payable annually on December 31.

■ MMI’s year-end was December 31. It did not accrue interest throughout the year.

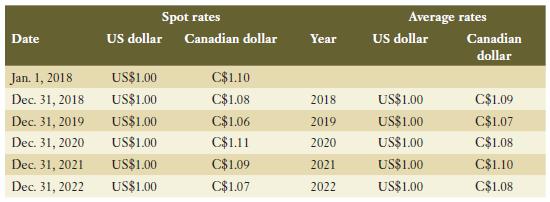

■ Exchange rates of consequence were:

Required:

Part I

Prepare journal entries to record:

a. Issuance of the bonds on January 1, 2018.

b. Revaluation of the liability on December 31, 2018.

c. Payment of interest on December 31, 2018.

d. Revaluation of the liability on December 31, 2022.

e. Payment of interest on December 31, 2022.

f. Derecognition of the liability on December 31, 2022.

Part II

Over the life of the bond, what was the total foreign exchange gain or loss reported due to borrowing in US dollars? Identify the amount that is attributable to:

(i) The change in exchange rates between the time the bonds were issued and derecognized; and

(ii) Purchasing US dollars for payment of interest at rates that differed from those used to determine interest expense.

Step by Step Answer: