Question: Required: 1. What amount did Office Depot report in its balance sheet related to the pension plan at December 31, 2017? 2. When calculating pension

Required:

1. What amount did Office Depot report in its balance sheet related to the pension plan at December 31, 2017?

2. When calculating pension expense at December 31, what amount, if any, did Office Depot include in its income statement as the amortization of unrecognized net actuarial loss (net loss—AOCI)? This AOCI account had a balance of $38 million at the beginning of the year and was the only AOCI account related to pensions. The average remaining service life of employees was 10 was years.

3. What was the pension expense?

4. What were the appropriate journal entries to record Office Depot’s pension expense and to record gains and/ or losses related to the pension plan?

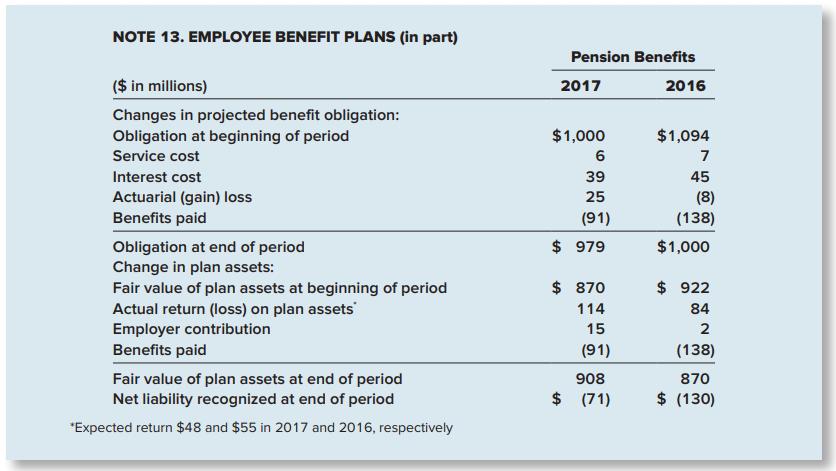

NOTE 13. EMPLOYEE BENEFIT PLANS (in part) Pension Benefits ($ in millions) 2017 2016 Changes in projected benefit obligation: Obligation at beginning of period $1,000 $1,094 Service cost 6 7 Interest cost 39 45 25 Actuarial (gain) loss Benefits paid (8) (138) (91) $ 979 Obligation at end of period Change in plan assets: Fair value of plan assets at beginning of period Actual return (loss) on plan assets Employer contribution Benefits paid $1,000 $ 870 $ 922 114 84 15 (91) (138) 908 Fair value of plan assets at end of period Net liability recognized at end of period 870 $ (71) $ (130) "Expected return $48 and $55 in 2017 and 2016, respectively

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Answer 1 The amount that Office Depot reported in its balance sheet related to the pension plan at D... View full answer

Get step-by-step solutions from verified subject matter experts