Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2012, Hamilton began work under contract #E2-D2,

Question:

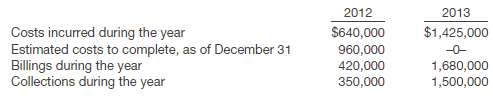

Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2012, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details are as follows.

Instructions(a) What portion of the total contract price would be recognized as revenue in 2012? In 2013 ?(b) Assuming the same facts as those shown on page 1139 except that Hamilton uses the cost-recovery method of accounting, what portion of the total contract price would be recognized as revenue in2013?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: