Question: The accounting system for Barker Ltd uses a general journal and special journals for sales, purchases, cash receipts and cash payments. Required A. What journal

The accounting system for Barker Ltd uses a general journal and special journals for sales, purchases, cash receipts and cash payments.

Required

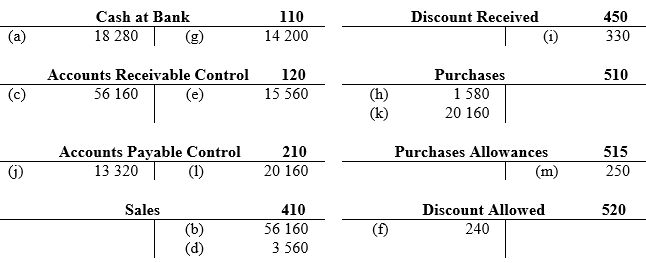

A. What journal would be the most probable source of the postings in the accounts?

B. Which of the above accounts would be affected if GST was recorded?

Cash at Bank 110 Discount Received 450 18 280 330 (a) (g) 14 200 (i) Accounts Receivable Control 120 Purchases 510 (e) 1 580 (c) 56 160 15 560 (h) (k) 20 160 Purchases Allowances (m) Accounts Payable Control (1) 210 515 G) 13 320 20 160 250 Sales 410 Discount Allowed 520 (b) (d) 56 160 (f) 240 3 560

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

A a Cash receipts journal h Cash payments journal b Sales ... View full answer

Get step-by-step solutions from verified subject matter experts