Question: The following data represent the differences between accounting and tax income for Oriental Imports Inc., whose pre-tax accounting income is $860,000 for the year ended

The following data represent the differences between accounting and tax income for Oriental Imports Inc., whose pre-tax accounting income is $860,000 for the year ended December 31. The company’s income tax rate is 40%. Additional information relevant to income taxes includes the following:

■ Capital cost allowance of $202,500 exceeded accounting depreciation expense of $100,000 in the current year.

■ Rents of $5,000, applicable to next year, had been collected in December and deferred for financial statement purposes but are taxable in the year received.

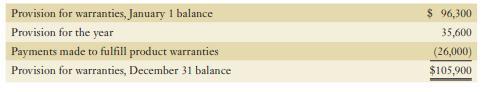

■ In a previous year, the company established a provision for product warranty expense. A summary of the current year’s transactions appears below:

For tax purposes, only actual amounts paid for warranties are deductible.

■ Insurance expense to cover the company’s executive officers was $5,200 for the year, and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Oriental Imports.

Provision for warranties, January 1 balance Provision for the year Payments made to fulfill product warranties Provision for warranties, December 31 balance $ 96,300 35,600 (26,000) $105,900

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

To record income taxes for Oriental Imports Inc you would make the following journal entries To reco... View full answer

Get step-by-step solutions from verified subject matter experts