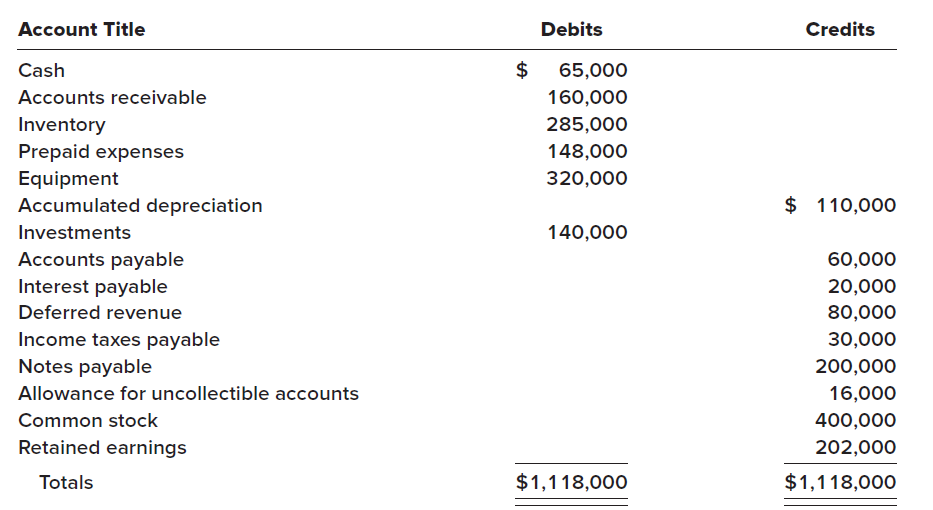

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing Company.

Question:

The following is the ending balances of accounts at December 31, 2021, for the Weismuller Publishing Company.

Additional Information:1. Prepaid expenses include $120,000 paid on December 31, 2021, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility.2. Investments include $30,000 in Treasury bills purchased on November 30, 2021. The bills mature on January 30, 2022. The remaining $110,000 is an investment in equity securities that the company intends to sell in the next year.3. Deferred revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less.4. The notes payable account consists of the following:a. a $40,000 note due in six months.b. a $100,000 note due in six years.c. a $60,000 note due in three annual installments of $20,000 each, with the next installment due August 31, 2022.5. The common stock account represents 400,000 shares of no par value common stock issued and outstanding. The corporation has 800,000 shares authorized.

Required:Prepare a classified balanced sheet for the Weismuller Publishing Company at December 31, 2021. Include headings for each classification, as well as titles for each classification?s subtotal. An example of a classified balance sheet can be found in the Concept Review Exercise at the end of Part A of this chapter.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas