Question: Use Nike, Inc.s balance sheet and other information provided below to answer the following questions. a. Compute Nikes working capital in 2019 and 2018. b.

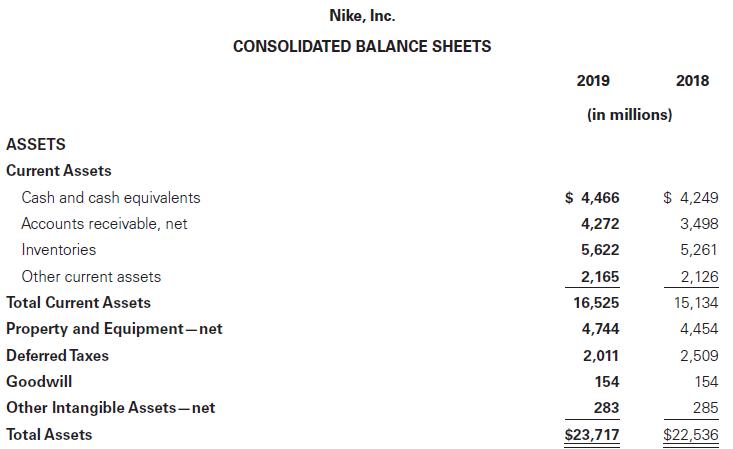

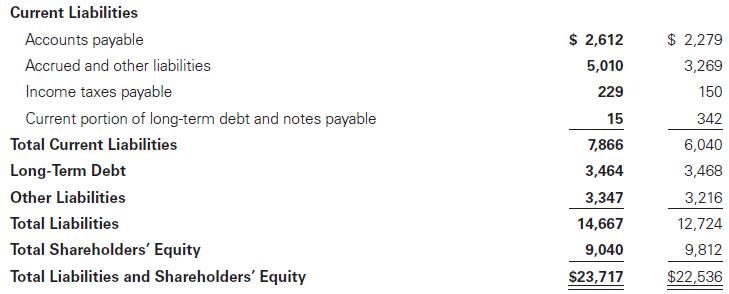

Use Nike, Inc.’s balance sheet and other information provided below to answer the following questions.

a. Compute Nike’s working capital in 2019 and 2018.

b. Compute Nike’s current ratio in 2019 and 2018.

c. Comment on what the working capital and current ratio indicate about Nike in 2019 and 2018.

d. Compute Nike’s debt-to-equity ratio for 2019 and 2018. Comment on what the debt-to-equity ratio indicates about Nike in 2019 and 2018.

e. Use DuPont Analysis to decompose Nike’s return on equity into return on assets and financial leverage. Nike’s net income in 2019 was $4,029 million. Comment on the effect of financial leverage on return on equity.

ASSETS Current Assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total Current Assets Property and Equipment-net Deferred Taxes Goodwill Other Intangible Assets-net Total Assets Nike, Inc. CONSOLIDATED BALANCE SHEETS 2019 (in millions) $ 4,466 4,272 5,622 2,165 16,525 4,744 2,011 154 283 $23,717 2018 $ 4,249 3,498 5,261 2,126 15,134 4,454 2,509 154 285 $22,536

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

To answer the questions lets go through each one step by step a Working capital is calculated as the difference between current assets and current liabilities Working Capital in 2019 Total Current Ass... View full answer

Get step-by-step solutions from verified subject matter experts