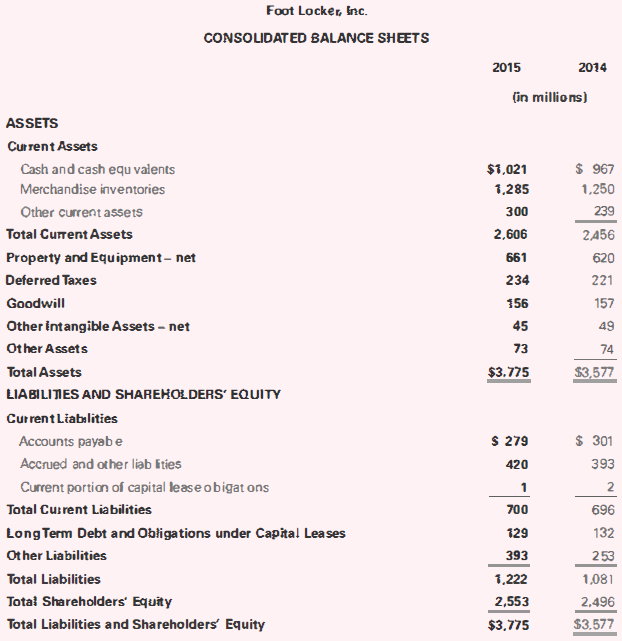

Use Foot Locker, Inc.'s balance sheet and other information provided on the next page to answer title

Question:

Use Foot Locker, Inc.'s balance sheet and other information provided on the next page to answer title following questions.

a. Compute Foot Locker's working capital in 2015 and 2014.

b. Compute Foot Locker's current ratio in 2015 and 2014.

c. Comment on what the working capital and current ratio indicate about Foot Locker in 2015 and 2014.

d. Compute Foot Locker's debt-to-equity ratio for 2015 and 2014. Comment on what the debt-to-equity ratio indicates about Foot Locker in 2015 and 2014.

e. Use DuPont analysis to decompose Foot Locker's return on equity into return on assets and financial leverage. Foot Locker's net income in 2015 was $541 million.

Comment on the effect of financial leverage on return on equity.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella