Use the following excerpt from the financial statements of Fixet Companys debt footnote (from Fixet Companys 2022

Question:

Use the following excerpt from the financial statements of Fixet Company’s debt footnote (from Fixet Company’s 2022 annual report) to answer these questions:

a. At December 31, 2022, what is the amount of the current portion of long-term debt?

b. How much debt will mature over the next 5 years?

c. What would be the difference in liabilities if Fixet reported the debt at fair values?

Fixet Company

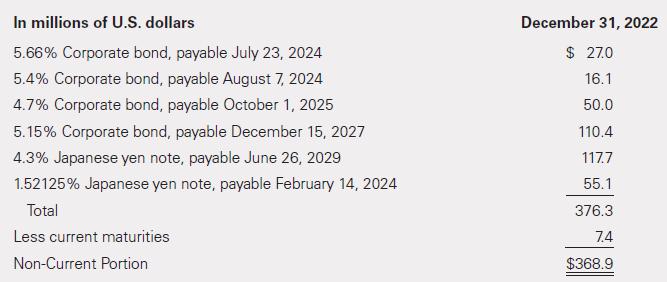

Note 9—Long-Term Debt [Excerpt]Long-term debt net of unamortized premiums and discounts and swap fair value adjustments is comprised of the following:

The scheduled maturity of long-term debt in each of the years ending December 31, 2023, through 2027, is $7.4 million, $172.1 million, $57.4 million, $47.4 million, and $7.3 million at face value, respectively. The Company’s long-term debt is recorded at adjusted cost, net of amortized premiums and discounts. The fair value of long-term debt is estimated based upon quoted prices for similar instruments. The fair value of the Company’s long-term debt, including the current portion, was approximately $403 million at December 31, 2022.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella