Question: Vanier Corporation reported the following information at the beginning of its current fiscal year: During the year, Vanier reported the following information: Income before

Vanier Corporation reported the following information at the beginning of its current fiscal year:

During the year, Vanier reported the following information:

■ Income before income taxes for the year was $850,000 and the tax rate was 32%.

■ Depreciation expense was $75,000 and the capital cost allowance was $80,000. The carrying amount of property, plant, and equipment at the end of the year was $420,000, while the undepreciated capital cost was $380,000.

■ Warranty expense was reported at $40,000, while actual cash paid out was $38,000. The warranty liability had a year-end balance of $10,000.

■ No other items have affected deferred tax amounts other than these transactions.

Required:

Prepare the journal entry or entries to record income tax for the year.

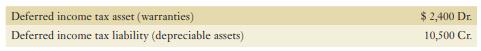

Deferred income tax asset set (warranties) Deferred income tax liability (depreciable assets) $ 2,400 Dr. 10,500 Cr.

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

There are a few different things that need to be considered when recording income tax for the year i... View full answer

Get step-by-step solutions from verified subject matter experts