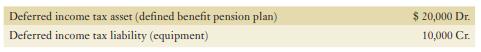

Singh Corporation reported the following information at the beginning of its current fiscal year: During the year,

Question:

Singh Corporation reported the following information at the beginning of its current fiscal year:

During the year, Singh reported the following information:

■ Income before income taxes for the year was $600,000.

■ Depreciation expense was $50,000 and capital cost allowance was $60,000. The carrying amount of property, plant, and equipment at the end of the year was $490,000, while its undepreciated capital cost was $440,000.

■ Defined benefit pension plan expense was $190,000, while the cash paid to the pension plan trustee was $205,000. The defined benefit pension plan liability had a year-end balance of $65,000.

The tax rate was 20%. No other items affected the deferred tax amounts during the year.

Required:

Prepare the journal entries to record income tax for the year.

Step by Step Answer: