Question: WW Development Inc. (WW), a real estate developer, was incorporated in Canada in 1975 by two brothers, Peter and David Wang. In the 1980s and

WW Development Inc. (WW), a real estate developer, was incorporated in Canada in 1975 by two brothers, Peter and David Wang. In the 1980s and 1990s, WW was quite successful. In early 2002, Peter and David€™s children took over the operations of WW and began acquiring properties to be held as revenue-producing properties rather than for development.

In recent years WW€™s profitability has suffered. Some of WW€™s creditors have expressed concern about WW€™s financial situation and are anxiously awaiting the results of the June 30, 2013, fiscal year-end. WW has some loans coming due in 2014. One creditor decided not to wait for the financial statements to be released and informed WW that it would not be renewing its loan.

Samuel & Samuel, Chartered Accountants, have been the auditors of WW since 1977 and have a good relationship with the Wang family. It is now September 5, 2013, and the fieldwork for the audit has been completed. The partner-in-charge of the WW engagement, Rylan Baseden, has completed his review of the working paper file. Samuel & Samuel recently established a quality control department to ensure that the firm meets professional standards for its work. Rylan has submitted the WW file to the quality control department for review, to take advantage of its expertise.

You, a new manager with Samuel & Samuel€™s quality control department, are to review the WW working paper file for the year ended June 30, 2013, and prepare a memo on the results of your review for the partner-in-charge of quality control. WW€™s relationship with its lenders is a major concern, and WW has undertaken to inform the lenders immediately of any issues identified by the auditors. The partner needs the memo for a meeting with Rylan that is to take place in three days.

You met with Rylan to familiarize yourself with WW€™s operations and gathered the information contained in Exhibit I. Rylan also gave you the WW financial statements, prepared in accordance with IFRS, and the WW working paper file. Extracts from the financial statements and the working paper file are provided in Exhibits II, III, and IV .

Required:

Prepare the memo.

Exhibit I

Excerpts from your conversation with the engagement partner

1. €œI have been doing the audit of WW for the last 10 years. I€™m glad to say I count the Wang brothers amongst my closest friends. They are not only great businessmen, they are excellent golfers!€

2. €œWW has not been doing very well in the last few years, but the Wangs assure me that the real estate market is turning around. The children have prepared forecasted earnings for the next five years that are very promising. I have not seen these forecasted earnings myself, but I believe them when they say that WW will do better in the future.€

3. €œAudit risk was assessed as low this year, as in previous years, because of my in-depth knowledge of the industry and the client. We have never had any reason to doubt management integrity. Nothing of significance has occurred in the current fiscal year to warrant changing our risk assessment.€

4. €œThree years ago, WW acquired a piece of land on the outskirts of town at a bargain price. Before being acquired by WW, the land had been for sale for many years without anyone showing any interest in it. WW wants to develop the land into a large residential complex for young professionals. If WW is successful in obtaining the necessary financing for the project, it anticipates making a

profit of approximately $16 million. The children have tried for the last 1½ years to obtain the

financing, without any luck. The banks say the land has no resale value. Peter and David are so confident about the project that they are prepared to provide personal guarantees to the bank if required.€

5. €œThe Rosdell shopping centre lost its anchor tenant in January 2003. The Wang children are not concerned because they can easily find a replacement.€

6. €œI almost forgot to tell you that the Glass Tower joint venture financial statements have not been audited. Another accountant issued a review engagement report on them. I told the staff that this

was sufficient since we are accounting for the Glass Tower joint venture using the equity method.€

7. €œWe also realized after we left the client€™s office that we had to issue an audit opinion on statements of operating expenses for the various revenue-producing properties. Thank goodness we had already done the work on those expenses for the regular audited financial statements of WW. We were able to rely on that work.€

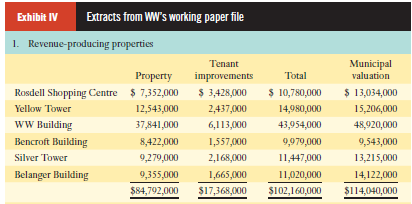

WW accounts for its investment properties using the cost model. The municipal valuations are based on market values that are reassessed every five years. WW€™s properties were last reassessed in 2009.

2. All properties have positive cash flows from operations except for the Rosdell Shopping Centre and the WW Building. Management says the Rosdell Shopping Centre will have a positive cash flow once the anchor tenant is replaced. As for the WW Building, management believes that even though the cash flows have been negative on this property for the last two years, the situation will soon turn around. Conclusion: no write down necessary.

3. Land held for development includes various small properties as well as the land on which WW plans to develop its residential project. This piece of land has a carrying value of $1,287,000. The net realizable value of this land is not an issue because the project will generate a substantial profit once the financing is obtained.

4. Mortgages receivable

Mortgage A

Mortgage receivable on June 30, 2012 ............................................. $1,988,000

Accrued interest .................................................................................. 159,000

Mortgage receivable on June 30, 2013 ............................................. $2,147,000

Exhibit IV

The mortgage is secured by a revenue-producing property with a fair market value of approximately $1,559,000. The property is located in a town where a car manufacturing plant is the town€™s sole industry. The plant closed down during the year and may not reopen.

No payments have been received on the mortgage since April 2012. The confirmation we sent came back from the borrower indicating the terms of the mortgage were changed by WW because the borrower was unable to make the previous debt repayments. The confirmation showed that the monthly payment was reduced by half. Starting in January 2014 the borrower will make monthly principal repayments of $16,567. The mortgage will continue to bear interest at 8%, the rate of the original mortgage.

Mortgage B

One of WW€™s revenue-producing properties was sold in 2011 to a developer, and a mortgage was taken back against the property. The property was sold because it was residential and the Wang children found the residential market to be too much work. No payments have been made by the developer since 2012, but the Wangs assured me that they spoke to the developer and were told that €œhe intends to resume making monthly payments as soon as possible.€ The balance of the mortgage is $3,288,000.

5. During the year, WW invested in a 40% interest in Glass Tower, a joint venture. The joint venture owns a revenue-producing property with a carrying value of $3.4 million and a mortgage of $3 million. Management accounted for this investment using the equity method. We agree with the treatment adopted by WW since the 60% venturer is operating the property and, even though the joint venture agreement gives one vote to each venturer, WW is not involved in the day-to-day operations.

6. WW must meet an interest coverage ratio of 0.50 or the bank can call its loan. The bank has agreed to such a low ratio because of its close relationship with the Wang family. Based on the

financial statements of June 30, 2013, WW is in compliance with the covenant, having an interest coverage ratio of 0.60. The interest coverage ratio is calculated using income before interest and income taxes. For 2013, the calculation is:

($5,130,000) + $117,00 + $12,407,000 / $12,407,000 = 0.60

7. Rental revenue analysis:

The decrease in rental revenue was mostly due to:

- The Rosdell anchor tenant leaving in January 1, 2013: $348,000

- An additional 13% vacancy in the Rosdell Shopping Centre since January 2013: $103,000

- Vacancies throughout the year in the WW Building: $258,000

8. In April 2013, some of the tenants of the Rosdell Shopping Centre made a legal representation to WW. The tenants asserted that if the anchor tenant was not replaced within six months, their leases would cease to be in force on the basis of breach of contract. They claim that they rented space in Rosdell mainly because of the presence of that particular anchor tenant.

9. The anchor tenant in the Rosdell Shopping Centre had to pay a cancellation fee of $450,000 to cancel its lease. This amount was included in income for the year.

10. The rental agency hired in May 2013 to find an anchor tenant for Rosdell says it will be lucky to find an anchor-type tenant in the next eight to ten months.

11. During the year, WW refinanced one of its revenue-producing property loans. WW paid a penalty of $1,230,000 to get out of the existing mortgage. Management said that it was worth it because the old $15,263,000 mortgage bore interest at 10.5% and matured in 2019. The new mortgage is for a period of 10 years at 9.5%. The annual principal repayments were reduced from $750,000 to $575,000.

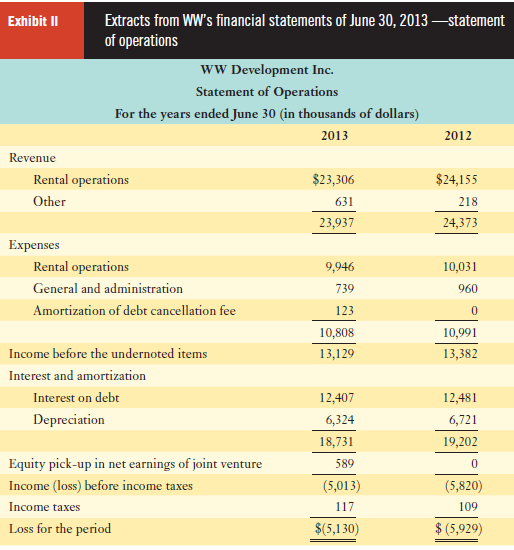

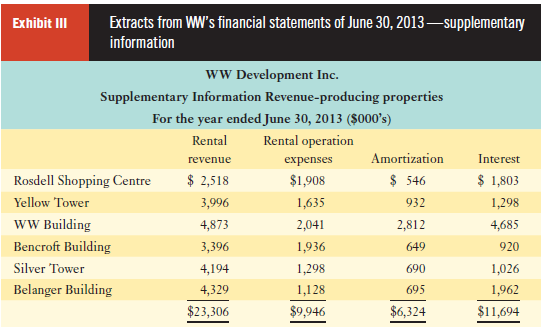

Extracts from WW's financial statements of June 30, 2013 statement of operations Exhibit II ww Development Inc. Statement of Operations For the years ended June 30 (in thousands of dollars) 2013 2012 Revenue $23,306 $24,155 Rental operations Other 631 218 23,937 24,373 Expenses Rental operations 9,946 10,031 General and administration 739 960 Amortization of debt cancellation fee 123 10,808 10,991 Income before the undernoted items 13,129 13,382 Interest and amortization Interest on debt 12,407 12,481 Depreciation 6,324 6,721 18,731 19,202 Equity pick-up in net earnings of joint venture 589 Income (loss) before income taxes (5,013) (5,820) 109 Income taxes 117 $ (5,929) Loss for the period $(5,130) Exhibit II Extracts from WW's financial statements of June 30, 2013 supplementary information WW Development Inc. Supplementary Information Revenue-producing properties For the year ended June 30, 2013 ($000's) Rental Rental operation expenses Amortization Interest revenue Rosdell Shopping Centre $ 2,518 $1,908 $ 546 $ 1,803 Yellow Tower 3,996 1,635 932 1,298 ww Building 4,873 2,041 2,812 4,685 Bencroft Building 3,396 1,936 649 920 Silver Tower 4,194 1,298 690 1,026 Belanger Building 4,329 1,128 695 1,962 $23,306 $9,946 $6,324 $11,694

Step by Step Solution

3.24 Rating (156 Votes )

There are 3 Steps involved in it

For completeness the following solution includes discussions of audit issues that would not be expected of students using this textbook Although useful for classroom discussion such audit issues shoul... View full answer

Get step-by-step solutions from verified subject matter experts