Question: Please show steps B D A Symbol Industry E Sec Market Value (LOCAL) H J P/E Ratio TTM 2 Div Yield 3y BETA company Price

Please show steps

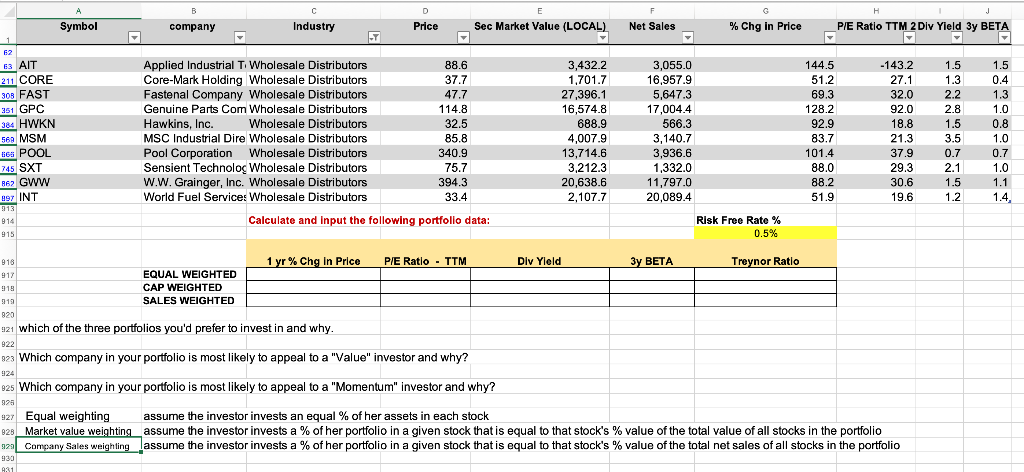

B D A Symbol Industry E Sec Market Value (LOCAL) H J P/E Ratio TTM 2 Div Yield 3y BETA company Price Net Sales % Chg in Price 144.5 62 63 AIT 211 CORE 303 FAST 251 GPC 384 HWKN 569 MSM BGS POOL 745 SXT 862 GWW 097 INT 913 914 915 Applied Industrial T. Wholesale Distributors 88.6 Core- Mark Holding Wholesale Distributors 37.7 Fastenal Company Wholesale Distributors 47.7 Genuine Parts Com Wholesale Distributors 114.8 Hawkins, Inc. Wholesale Distributors 32.5 MSC Industrial Dire Wholesale Distributors 85.8 Pool Corporation Wholesale Distributors 340.9 Sensient Technolog Wholesale Distributors 75.7 W.W. Grainger, Inc. Wholesale Distributors 394.3 World Fuel Service: Wholesale Distributors 33.4 Calculate and input the following portfolio data: : 3,432.2 1.701.7 27,396.1 16,574.8 688.9 4,007.9 13,714.6 3,212.3 20,638.6 2,107.7 3,055.0 16,957.9 5,647.3 17,004.4 566.3 3,140.7 3,936.6 1,332.0 11,797.0 20,089.4 51.2 69.3 128.2 92.9 83.7 101.4 88.0 88.2 51.9 -143.2 27.1 32.0 92.0 18.8 21.3 37.9 29.3 30.6 19.6 1.5 1.3 2.2 2.8 1.5 3.5 0.7 2.1 1.5 1.2 1.5 0.4 1.3 1.0 0.8 1.0 0.7 1.0 1.1 1.4 Risk Free Rate % 0.5% 918 1 yr%Chg In Price P/E Ratio - TTM Div Yield 3y BETA Treynor Ratio 917 EQUAL WEIGHTED 918 CAP WEIGHTED 919 SALES WEIGHTED 820 921 which of the three portfolios you'd prefer to invest in and why. 922 823 Which company in your portfolio is most likely to appeal to a "Value" investor and why? 925 Which company in your portfolio is most likely to appeal to a "Momentum" investor and why? 928 927 Equal weighting assume the investor invests an equal % of her assets in each stock 828 Market value weighting assume the investor invests a % of her portfolio in a given stock that is equal to that stock's % value of the total value of all stocks in the portfolio 12 Company Sales weighting assume the investor invests a % of her portfolio in a given stock that is equal to that stock's % value of the total net sales of all stocks in the portfolio 924 933 4311 B D A Symbol Industry E Sec Market Value (LOCAL) H J P/E Ratio TTM 2 Div Yield 3y BETA company Price Net Sales % Chg in Price 144.5 62 63 AIT 211 CORE 303 FAST 251 GPC 384 HWKN 569 MSM BGS POOL 745 SXT 862 GWW 097 INT 913 914 915 Applied Industrial T. Wholesale Distributors 88.6 Core- Mark Holding Wholesale Distributors 37.7 Fastenal Company Wholesale Distributors 47.7 Genuine Parts Com Wholesale Distributors 114.8 Hawkins, Inc. Wholesale Distributors 32.5 MSC Industrial Dire Wholesale Distributors 85.8 Pool Corporation Wholesale Distributors 340.9 Sensient Technolog Wholesale Distributors 75.7 W.W. Grainger, Inc. Wholesale Distributors 394.3 World Fuel Service: Wholesale Distributors 33.4 Calculate and input the following portfolio data: : 3,432.2 1.701.7 27,396.1 16,574.8 688.9 4,007.9 13,714.6 3,212.3 20,638.6 2,107.7 3,055.0 16,957.9 5,647.3 17,004.4 566.3 3,140.7 3,936.6 1,332.0 11,797.0 20,089.4 51.2 69.3 128.2 92.9 83.7 101.4 88.0 88.2 51.9 -143.2 27.1 32.0 92.0 18.8 21.3 37.9 29.3 30.6 19.6 1.5 1.3 2.2 2.8 1.5 3.5 0.7 2.1 1.5 1.2 1.5 0.4 1.3 1.0 0.8 1.0 0.7 1.0 1.1 1.4 Risk Free Rate % 0.5% 918 1 yr%Chg In Price P/E Ratio - TTM Div Yield 3y BETA Treynor Ratio 917 EQUAL WEIGHTED 918 CAP WEIGHTED 919 SALES WEIGHTED 820 921 which of the three portfolios you'd prefer to invest in and why. 922 823 Which company in your portfolio is most likely to appeal to a "Value" investor and why? 925 Which company in your portfolio is most likely to appeal to a "Momentum" investor and why? 928 927 Equal weighting assume the investor invests an equal % of her assets in each stock 828 Market value weighting assume the investor invests a % of her portfolio in a given stock that is equal to that stock's % value of the total value of all stocks in the portfolio 12 Company Sales weighting assume the investor invests a % of her portfolio in a given stock that is equal to that stock's % value of the total net sales of all stocks in the portfolio 924 933 4311

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts