You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine

Question:

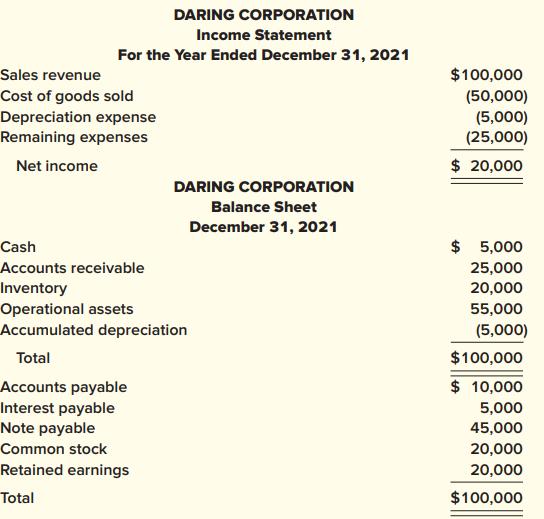

You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring Corporation. The application included the following financial statements.

It is not Daring’s profitability that worries you. The income statement submitted with the application shows net income of $20,000 in Daring’s first year of operations. By referring to the balance sheet, you see that this net income represents a 20% rate of return on assets of $100,000. Your concern stems from the recollection that the note payable reported on Daring’s balance sheet is a two-year loan you approved earlier in the year.

You also recall another promising new company that, just last year, defaulted on another of your bank’s loans when it failed due to its inability to generate sufficient cash flows to meet its obligations. Before requesting additional information from Daring, you decide to test your memory of the intermediate accounting class you took in night school by attempting to prepare a statement of cash flows from the information available in the loan application.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas