Ayres Services acquired an asset for $80 million in 2024. The asset is depreciated for financial reporting

Question:

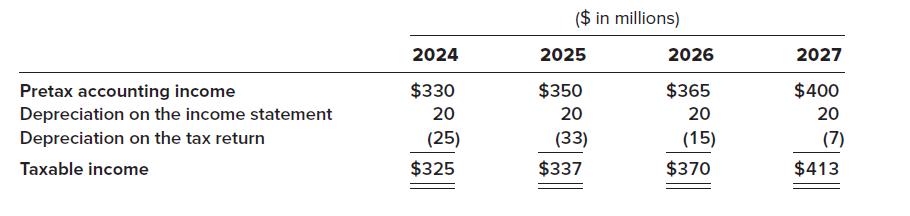

Ayres Services acquired an asset for $80 million in 2024. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset’s cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows:

Required:

For December 31 of each year, determine (a) the temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: