Question: Refer to the data provided in E 2127 for Red, Inc. Data from in E 21-27 Comparative balance sheets for 2024 and 2023, a statement

Refer to the data provided in E 21–27 for Red, Inc.

Data from in E 21-27

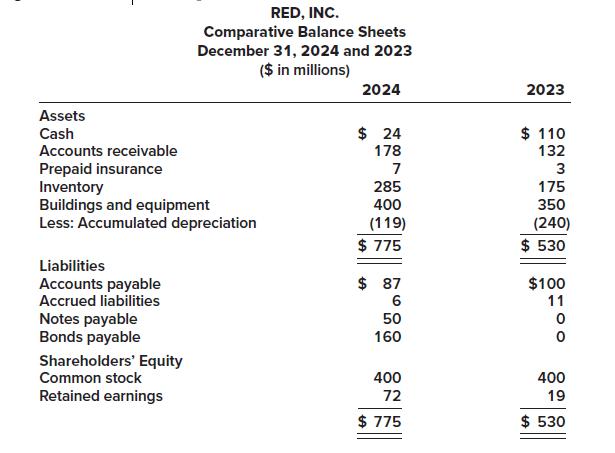

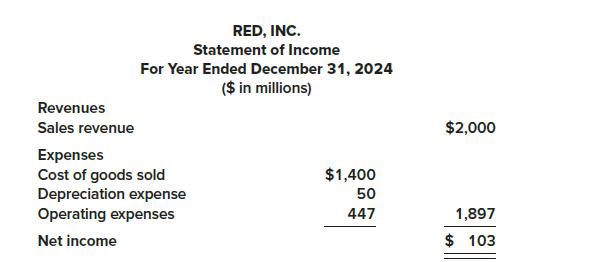

Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Inc., are provided below.

Additional information from the accounting records:

a. During 2024, $230 million of equipment was purchased to replace $180 million of equipment (95% depreciated) sold at book value.

b. In order to maintain the usual policy of paying cash dividends of $50 million, it was necessary for Red to borrow $50 million from its bank.

Required:

Prepare the statement of cash flows for Red, Inc., using the indirect method to report operating activities.

Assets Cash Accounts receivable Prepaid insurance Inventory Buildings and equipment Less: Accumulated depreciation Liabilities Accounts payable Accrued liabilities Notes payable Bonds payable RED, INC. Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) Shareholders' Equity Common stock Retained earnings 2024 $24 178 7 285 400 (119) $ 775 $87 6 50 160 400 72 $ 775 2023 $ 110 132 3 175 350 (240) $ 530 $100 11 0 0 400 19 $ 530

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Balance Sheet Assets Cash RED INC Spreadsheet for the Statement of Cash Flows Accounts receivable Pr... View full answer

Get step-by-step solutions from verified subject matter experts