Refer to the situation described in P 1710. Assume Electronic Distribution prepares its financial statements according to

Question:

Refer to the situation described in P 17–10. Assume Electronic Distribution prepares its financial statements according to International Financial Reporting Standards (IFRS). Also assume that 10% is the current interest rate on high-quality corporate bonds.

Data from in P 17-10

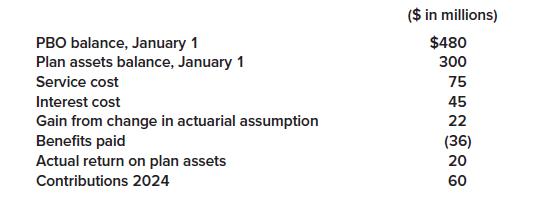

Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2024 are as follows:

The expected long-term rate of return on plan assets was 8%. There were no AOCI balances related to pensions on January 1, 2024, but at the end of 2024, the company amended the pension formula, creating a prior service cost of $12 million.

Required:

1. Calculate the net pension cost for 2024, separating its components into appropriate categories for reporting.

2. Prepare the journal entries to record (a) the components of net pension cost, (b)gains or losses, (c) past service cost, (d) funding, and (e) payment of benefits for 2024.

3. What amount will Electronic Distribution report in its 2024 balance sheet as a net pension asset or net pension liability?

Step by Step Answer: