Question: A contractor is preparing to bid for a project. He has his cost estimate and the work schedule. Table P6.4 gives his expected expenses and

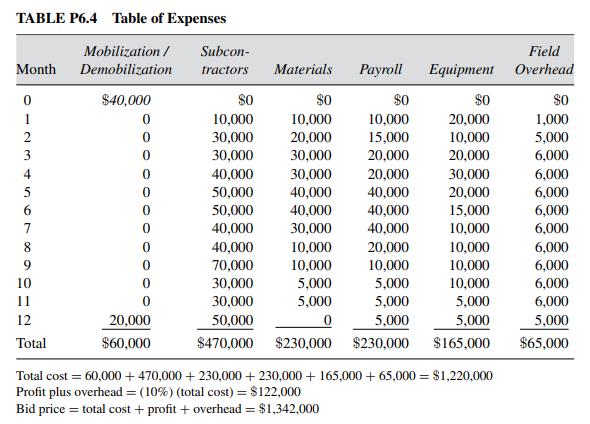

A contractor is preparing to bid for a project. He has his cost estimate and the work schedule. Table P6.4 gives his expected expenses and their time of occurrence. Other expenses such as insurance, bonds, and payroll taxes are included. For simplicity of analysis, he assumed that all expenses are recognized at the end of the month in which they occur.

The contractor is planning to add 10% to his estimated expenses to cover profits and office expenses. The total will be his bid price. He is also planning to submit for his progress payment at the end of each month. Upon approval the owner will subtract 5% for retainage and pay the contractor one month later. The accumulated retainage will be paid to the contractor with the last payment (i.e., at the end of month 13). What is the peak financial requirement and when does it occur?

TABLE P6.4 Table of Expenses Mobilization/ Month Demobilization tractors Subcon- Field Materials Payroll Equipment Overhead 0123456789 $40,000 $0 $0 $0 $0 $0 0 10,000 10,000 10,000 20,000 1,000 0 30,000 20,000 15,000 10,000 5,000 0 30,000 30,000 20,000 20,000 6,000 40,000 30,000 20,000 30,000 6,000 50,000 40,000 40,000 20,000 6,000 50,000 40,000 40,000 15,000 6,000 40,000 30,000 40,000 10,000 6,000 40,000 10,000 20,000 10,000 6,000 70,000 10,000 10,000 10,000 6,000 10 11 12 Total 0 30,000 5,000 5,000 10,000 6,000 30,000 5,000 5,000 5,000 6,000 20,000 50,000 0 5,000 5,000 5,000 $60,000 $470,000 $230,000 $230,000 $165,000 $65,000 Total cost = 60,000+ 470,000+230,000 + 230,000+165,000+ 65,000 = $1,220,000 Profit plus overhead = (10%) (total cost) = $122,000 Bid price = total cost + profit + overhead = $1,342,000

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts