Whilst preparing financial statements for the year to 30 June 2023, a company discovers that (owing to

Question:

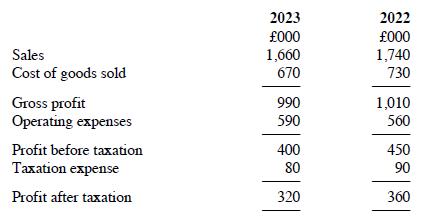

Whilst preparing financial statements for the year to 30 June 2023, a company discovers that (owing to an accounting error) the sales figure for the year to 30 June 2022 had been understated by £100,000. Trade receivables had been understated by the same amount. This error is regarded as material. An extract from the company's draft statement of comprehensive income for the year to 30 June 2023, before correcting this error, is as follows:

The additional trade receivables of £100,000 are still outstanding at 30 June 2023. The sales figure for the year to 30 June 2023 shows only the sales revenue for that year and does not include the sales of £100,000 which were omitted from the previous year's financial statements. Retained earnings at 30 June 2022 were originally reported as £1,220,000. No dividends were paid during the two years to 30 June 2023. It may be assumed that the company's taxation expense is always equal to 20% of the profit before taxation.

Required:(a) Revise the extract from the statement of comprehensive income for the year to 30 June 2023, showing restated comparative figures for the year to 30 June 2022.(b) Prepare an extract from the company's statement of changes in equity for the year to 30 June 2023, showing changes to retained earnings.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville