As a risk analyst, you are asked to look at EB Corporation, which has issued both equity

Question:

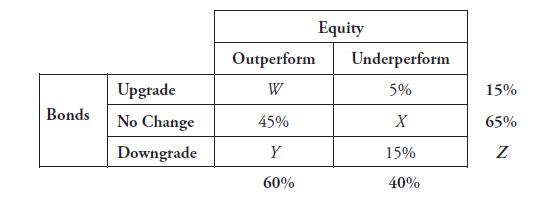

As a risk analyst, you are asked to look at EB Corporation, which has issued both equity and bonds. The bonds can either be downgraded, be upgraded, or have no change in rating. The stock can either outperform the market or underperform the market.

You are given the following probability matrix from an analyst who had worked on

the company previously, but some of the values are missing. Fill in the missing values.

What is the conditional probability that the bonds are downgraded, given that the equity has underperformed?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Quantitative Financial Risk Management

ISBN: 9781119522201,9781119522263

1st Edition

Authors: Michael B. Miller

Question Posted: