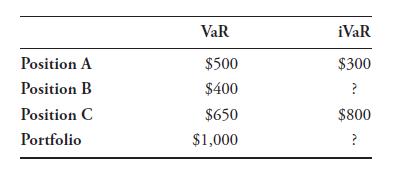

You have been given the following VaR and iVaR statistics for a portfolio that contains three positions.

Question:

You have been given the following VaR and iVaR statistics for a portfolio that contains three positions. What is the iVaR of Position B? Assume the iVaR and VaR are both one-day 95%, and have been calculated using the same methodology.

Transcribed Image Text:

Position A Position B Position C Portfolio VaR $500 $400 $650 $1,000 iVaR $300 ? $800 ? 'V

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The iVaR of Position B is 100 For the portfolio as a w...View the full answer

Answered By

Jacob Festus

I am a professional Statistician and Project Research writer. I am looking forward to getting mostly statistical work including data management that is analysis, data entry using all the statistical software’s such as R Gui, R Studio, SPSS, STATA, and excel. I also have excellent knowledge of research and essay writing. I have previously worked in other Freelancing sites such as Uvocorp, Essay shark, Bluecorp and finally, decided to join the solution inn team to continue with my explicit work of helping dear clients and students achieve their Academic dreams. I deliver, quality and exceptional projects on time and capable of working under high pressure.

4.90+

1250+ Reviews

2838+ Question Solved

Related Book For

Quantitative Financial Risk Management

ISBN: 9781119522201,9781119522263

1st Edition

Authors: Michael B. Miller

Question Posted:

Students also viewed these Business questions

-

Suppose you are the manager for 3 West, a medical/surgical unit. You have been given the following data to assist you in preparing your budget for the upcoming fiscal year. Patient Data ADC: 54...

-

You have been given the following condensed financial data for two companies from different industries: Instructions Divide the class into groups. Assign half your group members to Utility Corp. and...

-

Solve each equation in Exercises. Round decimal answers to four decimal places. log 3 (x 2 + 17) - log3 (x + 5) = 1

-

On January 1, Harry's Hot Dogs purchased a hot dog stand for $120,000 with an estimated useful life of 10 years and no residual value. Suppose that after using the hot dog stand for four years and...

-

List several ways that business organizations compete.

-

Mary Kay Morrow began working for Hallmark in 1982. At the beginning of 2002, Hallmark adopted the Hallmark Dispute Resolution Program, which required, among other things, that claims against the...

-

Belmain Co. expects to maintain the same inventories at the end of 2014 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of...

-

25 25 What is the output of the following code? [ (5 Puan) public class MyClass{ private static int x; public MyClass (int x) ( } this.x x; public static void printX() { ) System.out.println(x);...

-

Liquid reaction A --> 2B is taking place in a steady state packed bed reactor that has total available packing area (A) of 10 m. The density (p) and packing surface (a) of the catalyst per volume are...

-

The total VaR of a portfolio is $10 million. The portfolio contains a position in XYZ worth $1 million, with an iVaR of $3 million. What would the approximate VaR of the portfolio be if the XYZ...

-

You have created a Monte Carlo simulation to model the risk of a stock index over 10,000 days. All of the daily log returns have a mean, standard deviation, skewness, and excess kurtosis of 0.10%,...

-

The Brick Company had cash sales of $280,000 for Year 1, its first year of operation. On April 2, the company purchased 210 units of inventory at $390 per unit. On September 1, an additional 160...

-

A researcher is pondering what survey mode to use for a client that markets a home security system. The system consists of tiny motion sensors that are pressed onto all of the windows and doors. Once...

-

Compu-Ask Corporation has developed a stand-alone computerized interview system that can be adapted to almost any type of survey. It can be loaded onto a tablet computer, which allows respondents to...

-

Express the following relationships as formulas: (a) Revenue, gross profit, and net profit. (b) Opening inventory, closing inventory, purchases, and cost of sales. (c) The balance brought forward on...

-

Discuss the feasibility of each type of survey mode for each of the following cases: a. Polo wants to test a new cologne scent called Extreme Red. b. Snagjob needs to determine how many businesses...

-

Why do investors and managers need to understand how to estimate a firms intrinsic value?

-

Icicles Liquid water coats an active (growing) icicle and extends up a short, narrow tube along the central axis (Figure). Because the waterice interface must have a temperature of 0 o 'C, the water...

-

The Zwatch Company manufactures trendy, high-quality moderately priced watches. As Zwatch's senior financial analyst, you are asked to recommend a method of inventory costing. The CFO will use your...

-

How would a collar be valued practically? What is the explicit solution for a single payment?

-

When an index amortizating rate swap has a lockout period for the first year, we must solve with jump condition where g(r, i) =1 if ti < 1, and with final condition V(r, P, T ) = (r rf )P. In this...

-

Find the approximate value of a cashflow for a floorlet on the one-month LIBOR, when we use the Vasicek model.

-

Explain and distinct between disjoint and overlapping constraints. Illustrate your answer with suitable examples for each constraint.

-

Suppose you have to design a database of the university where the university has different departments and departments have different programs in different program different subjects are Offord that...

-

The relational schema of the database, which is about the Library Management System, is provided below: BOOK BookID, Title, Author, Publisher, PublishDate, ISBN, Category, Language, TotalCopies,...

Study smarter with the SolutionInn App