Analysis of a binary option trading website. a) In a one-step model with risky asset prices (S_{0},

Question:

Analysis of a binary option trading website.

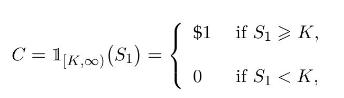

a) In a one-step model with risky asset prices \(S_{0}, S_{1}\) at times \(t=0\) and \(t=1\), compute the price at time \(t=0\) of the binary call option with payoff

in terms of the probability \(p^{*}=\mathbb{P}^{*}\left(S_{1} \geqslant Kight)\) and of the risk-free interest rate \(r\).

b) Compute the two potential net returns obtained by purchasing one binary call option.

c) Compute the corresponding expected (net) return.

d) A website proposes to pay a return of \(86 \%\) in case the binary call option matures "in the money", i.e. when \(S_{1} \geqslant K\). Compute the corresponding expected (net) return. What do you conclude?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault

Question Posted: