Consider a risky asset valued (S_{0}=$ 4) at time (t=0), and taking only two possible values (S_{1}

Question:

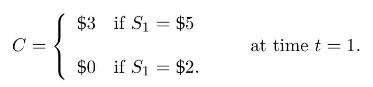

Consider a risky asset valued \(S_{0}=\$ 4\) at time \(t=0\), and taking only two possible values \(S_{1} \in\{\$ 5, \$ 2\}\) at time \(t=1\), and the claim payoff

We assume that the issuer charges \(\$ 1\) for the option contract at time \(t=0\).

a) Compute the portfolio allocation \((\xi, \eta)\) made of \(\xi\) stocks and \(\$ \eta\) in cash, so that:

i) the full \(\$ 1\) option price is invested into the portfolio at time \(t=0\), and ii) the portfolio reaches the \(C=\$ 3\) target if \(S_{1}=\$ 5\) at time \(t=1\).

b) Compute the loss incurred by the option issuer if \(S_{1}=\$ 2\) at time \(t=1\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault

Question Posted: