Consider a two-step binomial market model (left(S_{t}ight)_{t=0,1,2}) with (S_{0}=1) and stock return rates (a=0, b=1), and a

Question:

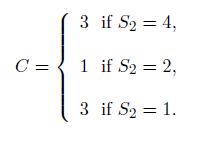

Consider a two-step binomial market model \(\left(S_{t}ight)_{t=0,1,2}\) with \(S_{0}=1\) and stock return rates \(a=0, b=1\), and a riskless account priced \(A_{t}=(1+r)^{t}\) at times \(t=0,1,2\), where \(r=0.5\). Price and hedge the tunnel option whose payoff \(C\) at time \(t=2\) is given by

Transcribed Image Text:

C = 3 if S = 4, 1 if S = 2, 3 if S = 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

We have p raba 12 and q brb...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault

Question Posted:

Students also viewed these Business questions

-

Consider a series of end-of -period CFs spanning 2045-2056, which decrease by a fixed amount each period. The amount of the first CF in the series is $1,097 and the decrement is $73. The interest...

-

We consider a two-step binomial market model \(\left(S_{t}ight)_{t=0,1,2}\) with \(S_{0}=1\) and return rates \(R_{t}=\left(S_{t}-S_{t-1}ight) / S_{t-1}, t=1,2\), taking the values \(a=0, b=1\), and...

-

Consider the following information regarding Domino Pizza Enterprizes Ltd, a listed company in: Australia: Risk-free rate 2.2% Market Risk Premium 7.0% Beta of Share: 0.95 Last Dividend paid $4.50...

-

What are the income-distribution consequences of fashion? Can the need to be seen driving a new car by the rich be a boon to those with lower incomes who will ultimately purchase a better,...

-

Solve. 1. Multiply 70 by 12. 2. Find the product of 9 and 900. 3. Find 3 times 3310. 4. One ounce of hulled sunflower seeds contains 14 grams of fat. How many grams of fat are in 8 ounces of hulled...

-

Menounos Manufacturing Co. uses standard costs. Standard costs and actual costs for direct labor and factory overhead for the manufacture of 3,000 units during 20Y6 were as follows: Each unit...

-

Would the critical Rayleigh number for flow transition for the Bnard problem increase or decrease with the Prandtl number? Explain why in terms of the physics of the problem.

-

Dali Corporation??s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $240,000 for changes in operating assets and liabilities to arrive at net cash...

-

Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its...

-

In a two-step trinomial market model \(\left(S_{t}ight)_{t=0,1,2}\) with interest rate \(r=0\) and three return rates \(R_{t}=-0.5,0,1\), we consider a down-an-out barrier call option with exercise...

-

Consider a two-step trinomial market model \(\left(S_{t}^{(1)}ight)_{t=0,1,2}\) with \(r=0\) and three possible return rates \(R_{t}=-1,0,1\), and the risk-neutral probability measure...

-

The following information was summarized from the consolidated balance sheets of Walgreen Co. and Subsidiaries as of August 31, 2010 and 2009 and the consolidated statements of earnings for the years...

-

The implementation of AVL trees described in this chapter introduced two helper methods, Difference and Height, to compute the balance factor of a given node. Another approach would be to store the...

-

1. Show the adjacency matrix that would describe the edges in the graph. Store the vertices in alphabetical order. 2. Show the array-of-pointers adjacency lists that would describe the edges in the...

-

What is the key feature of top-down design?

-

Which of these statements is always true? 1. All of the program requirements must be completely defined before design begins. 2. All of the program design must be complete before any coding begins....

-

Is there any way a single programmer (for example, a student working alone on a programming assignment) can benefit from some of the ideas behind the inspection process?

-

Why do you think organizations have increased the use of groups for making decisions? When would you recommend using groups to make decisions?

-

Choose a company from the SEC EDGAR Web site for your Key Assignment to evaluate for the impact of convergence to IFRS. Review the financial reports and notes of the company you have chosen from the...

-

Explain why determining a firms optimum debt/equity mix is important.

-

How did the Feds loose money policies after the 20072009 Great Recession affect investors?

-

What is the relationship between a firms cost of capital and investor required rates of return?

-

Considering the banks' image repair case, how may the fact that 56% of the consumers is a customer of a very responsible bank affect the validity and/or reliability of the findings of Ralph's study?...

-

Select a public health problem or health issue and describe communication channels, vehicles, and platforms used to deliver messages related to that problem or issue. What are the limitations of...

-

Assuring that the consent agreement procedure follows guidelines for social work within an organization for the use of social media and technology Explain how HIPAA and HITECH would be used in an...

Study smarter with the SolutionInn App