At the end of FY20xx MRI Imaging has determined they need to increase their imaging capabilities to

Question:

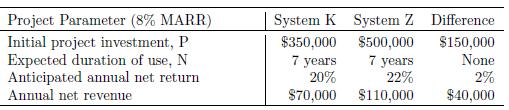

At the end of FY20xx MRI Imaging has determined they need to increase their imaging capabilities to compete in the growing sports health management arena. Their closest competitor has three times the imaging capital equipment and they run at 82% capacity. MRI's board of directors estimates they could safely add \($500,000\) in capacity and the regional market would still not be saturated. The funds for the project are to be obtained by allocating \($350,000\) in retained earnings from the prior year and using \($150,000\) from their line of credit, if needed. The company was expecting to use the same imaging vendor they've always used, and the \($350,000\) investment in System K would produce a net rate of return of 20%; the return is considered fairly good in the down service economy where the company MARR has dropped to 8%. A new imaging vendor hears about the potential sale and offers a more advanced System Z that costs \($500,000,\) though; the vendor claims the higher net rate of return of 22% is \worth it in the long run." The argument is that the higher cost enables faster imaging and greater patient throughput. \You'll make up the difference in the capital cost in three years," exclaims the salesman. MRI is a conservative company, and the board is inclined to spend as little on capital equipment as possible. Can it be argued that the more expensive system is worth it?

Step by Step Answer: