Question: Projects A, B, and C are being considered by a firm with a MARR of $18 %$. The company has lagged competitors for years, and

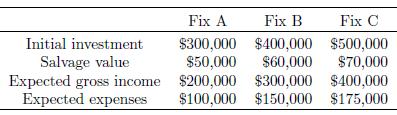

Projects A, B, and C are being considered by a firm with a MARR of $18 \%$. The company has lagged competitors for years, and changes in the FDA regulations means something must be done soon. Management does not want to deal with the problem again for the foreseeable future and asked for cash-flow estimates for the next 10-year period.

With a maximum capital budget of $\$ 900 \mathrm{~K}$, what combination of projects makes sense to invest in?

Fix A Fix B Fix C Initial investment Salvage value Expected gross income Expected expenses $300,000 $400,000 $500,000 $50,000 $60,000 $70,000 $200,000 $300,000 $400,000 $100,000 $150,000 $175,000

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts