Question: Three mutually exclusive projects all have the same life of 5 years and the MARR is $10 %$. Is there a difference in selection outcome

Three mutually exclusive projects all have the same life of 5 years and the MARR is $10 \%$. Is there a difference in selection outcome if rate of return or present worth is used in the analysis? Which alternative is the preferred investment?

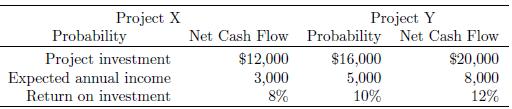

Project X Project Y Probability Net Cash Flow Probability Net Cash Flow Project investment Expected annual income Return on investment $12,000 $16,000 $20,000 3,000 5,000 8,000 8% 10% 12%

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Based on the information provided in the sources the question is asking about the selection outcome of three mutually exclusive projects with the same ... View full answer

Get step-by-step solutions from verified subject matter experts