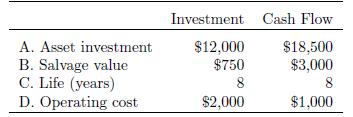

Which of the alternatives described below is more economical if (a) the assets are depreciated on a

Question:

Which of the alternatives described below is more economical if

(a) the assets are depreciated on a straight-line basis,

(b) the tax rate is $40 \%$, and

(c) the after-tax MARR is $6 \%$ ?

1. How does the outcome change if this was a before-tax analysis?

2. What is the after-tax result if the life had to be shortened by 3 years?

3. Describe the difference between a before-tax and after-tax MARR.

4. Perform a parametric analysis on the corporate tax rate and explore what impact this might have on decision-making.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: