Tax credits enabled and persuaded a company to invest in a new single material 3-D prototyping machine.

Question:

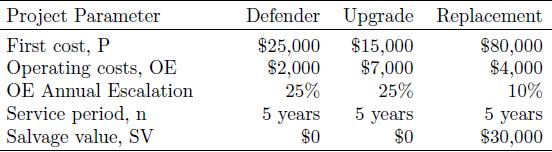

Tax credits enabled and persuaded a company to invest in a new single material 3-D prototyping machine. A year after the system was up and running, two-material 3-D prototyping became the rage, and anyone who was not at the leading edge was losing customers. The company had a choice of

(a) overhauling the current system at a lower initial cost but with higher long-term maintenance costs, or

(b) replacing the system outright with lower long-term maintenance costs.

Assume that management is seeking an aggressive return (because of past errors) and sets MARR $=22 \%$. As well, assume that due to the rapidly changing technology environment the equipment has no salvage value at the end of the 5th year. Straight-line depreciation is used for simplicity. Which alternative is most favorable?

Step by Step Answer: